The World’s Smartphone Revolution: How 2025 Changed Performance, Pricing, and Priorities

The morning alarm isn’t just a ringtone anymore—it’s a calculated blend of soundscapes tuned to wake you gently, while your notifications are intelligently prioritized. In 2025, smartphones have quietly transitioned from mere communication tools to orchestrators of daily life, anticipating user behavior before a finger even touches the screen. From the polished metallic frames to adaptive AI-driven displays, each device is a microcosm of global design philosophy and engineering precision.

Across cafés in Berlin, co-working spaces in Singapore, and metro hubs in New York, users instinctively interact with smartphones that seem to know them. Latency is nearly imperceptible; gestures are interpreted with near-telepathic accuracy. This era of smartphones isn’t about specs in isolation—it’s about the subtle choreography between performance, efficiency, and personalized experience. Even a brief scroll or a single tap reflects decisions informed by global engineering trends and cultural priorities.

Beneath this surface, manufacturers are grappling with unprecedented challenges: balancing chip efficiency with thermal management, integrating AI without sacrificing battery life, and aligning global pricing strategies to diverse markets. The narrative of 2025 smartphones isn’t confined to glossy launch events; it unfolds quietly in the lived experience of users navigating apps, calls, media, and productivity tools seamlessly. The revolution is invisible yet omnipresent, shaping perception as much as it defines performance.

Why This Product Exists: The Forces Behind the 2025 Shift

The push toward 2025’s smartphone evolution stems from converging pressures: consumer demand for performance without compromise, environmental sustainability mandates, and global market competition accelerating feature innovation. Hardware, software, and services are no longer siloed—they converge to deliver seamless efficiency.

| Engineering Evolution | Problem It Actually Solved |

|---|---|

| Multi-core ARM processors | High-performance computing in compact devices |

| AI-driven battery management | Longer battery life without manual optimization |

| Adaptive refresh rate displays | Optimized energy consumption and smoother visuals |

| Modular camera and sensor arrays | Flexibility for photography and AR applications |

| Globalized chipset sourcing | Reduced regional pricing disparities & supply chain resilience |

Manufacturers recognized that users no longer valued raw specifications alone. The intent shifted to harmonizing performance, efficiency, and user-centric features while maintaining global accessibility.

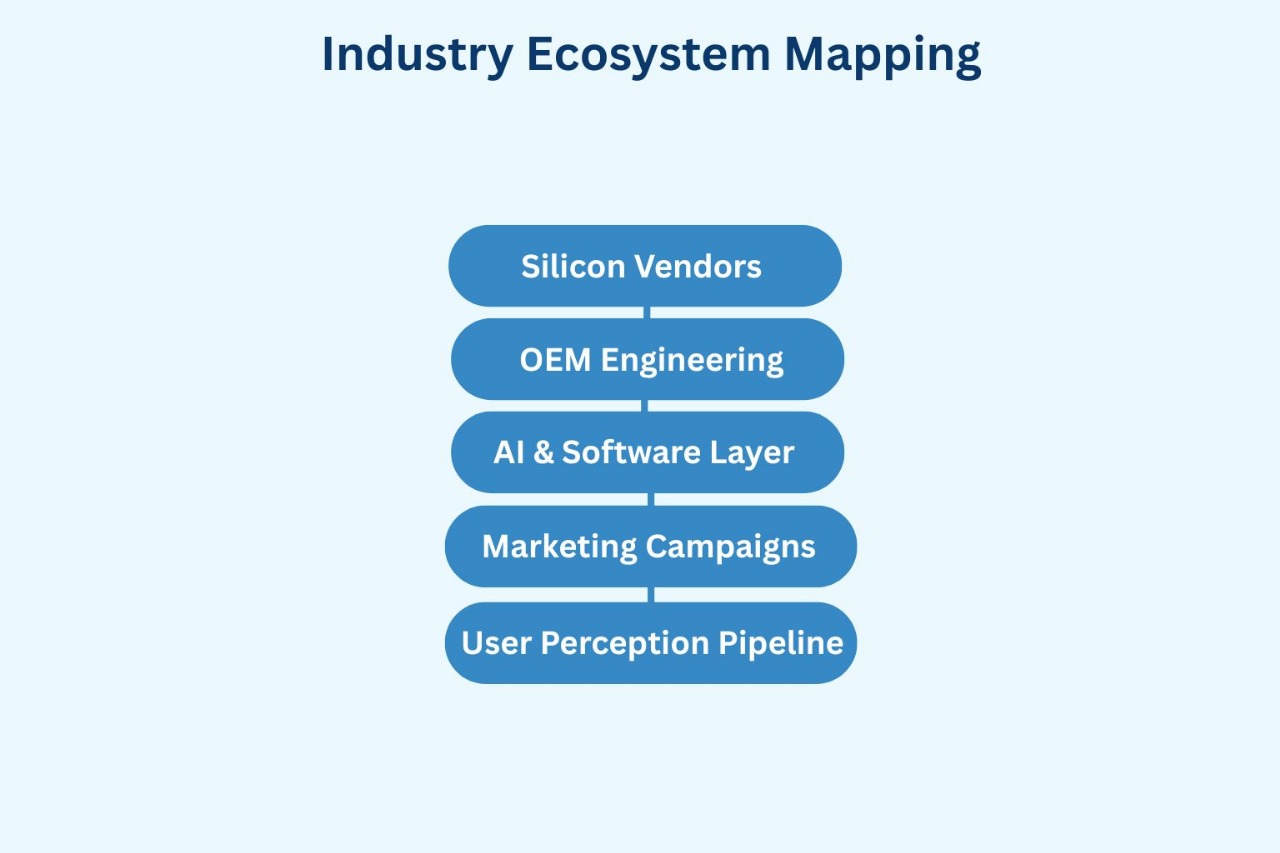

Industry Ecosystem Mapping: How Global Smartphones Are Engineered and Delivered

Behind every flagship lies a sprawling ecosystem. OEMs source chips from multiple silicon vendors, negotiate supply contracts across continents, and integrate complex software stacks. Marketing strategies ripple across regions, shaping perception and purchase intent.

This chain illustrates how technical choices, brand storytelling, and regional dynamics intersect. The ecosystem isn’t linear; it’s a loop where feedback from user behavior feeds back into product design and marketing, creating a continuous cycle of refinement. The 2025 smartphone landscape is defined as much by this orchestration as by the physical device itself.

Engineering Core Breakdown: Balancing Performance, Thermal, and Power

Every millimeter of modern smartphones is a negotiation between physics and ambition. Engineers contend with thermal envelopes dictated by high-performance processors, battery capacities constrained by form factor, and signal-chain integrity for 5G, Wi-Fi, and sensor arrays.

| Real-World Engineering Trade-Offs | Effect on User Experience |

|---|---|

| Higher clock speeds | Better performance but increased heat |

| Thinner batteries | Sleeker design but limited charge cycles |

| Multi-sensor camera integration | Superior imaging at the cost of device thickness |

| Advanced cooling solutions | Maintains performance but adds weight |

| AI workload offloading | Smoother multitasking but requires software optimization |

Designing for 2025 means understanding the user journey and anticipating scenarios—from gaming bursts to AR navigation—while respecting physical limitations and energy budgets.

Human Psychology Layer: Perception and Interaction in 2025

Smartphones in 2025 don’t just respond—they anticipate. Perceptual biases shape how users interpret responsiveness, color accuracy, haptic feedback, and sound. A slight delay in touch sensitivity can feel longer than it is, while adaptive display brightness tricks the eye into perceiving richer contrast.

Emotional responses are tightly coupled with micro-interactions. Notifications, vibrations, and subtle UI animations are calibrated to reduce cognitive load while maximizing satisfaction. Latency, sharpness, and audio fidelity are no longer just metrics—they define how users feel the device respects their attention and effort.

| Emotion | Perception | Behavior |

|---|---|---|

| Satisfaction | Smooth scrolling, accurate haptics | Prolonged usage, engagement |

| Frustration | Lag or stuttering | Switching apps, possible churn |

| Delight | Adaptive AI suggestions | Sharing content, social engagement |

| Confidence | Reliable battery and signal | Increased dependency on device |

| Curiosity | Innovative camera and AR features | Exploration of device capabilities |

Understanding these human factors allows OEMs to design experiences that feel seamless, even when underlying engineering is pushing boundaries.

Material & Form Philosophy: The Touch of 2025

In 2025, smartphone material selection balances symbolism, ergonomics, and durability. Users associate premium metals and ceramics with reliability, while matte finishes reduce fingerprint visibility and provide a tactile reassurance. Form is as much about identity as function.

| Material Type | Typical Use Case | User Perception & Behavior |

|---|---|---|

| Aluminum Alloy | Flagship frames | Premium feel, lightweight |

| Ceramic Back Panels | High-end photography models | Scratch resistance, tactile prestige |

| Polycarbonate | Mid-tier smartphones | Functional, cost-effective |

| Gorilla Glass Victus | Display protection | Durability reassurance, confident handling |

| Recycled Materials | Sustainability-focused devices | Ethical appeal, conscious purchase choice |

Material choices communicate brand intent and subtly influence user loyalty, with tangible surfaces shaping long-term perception.

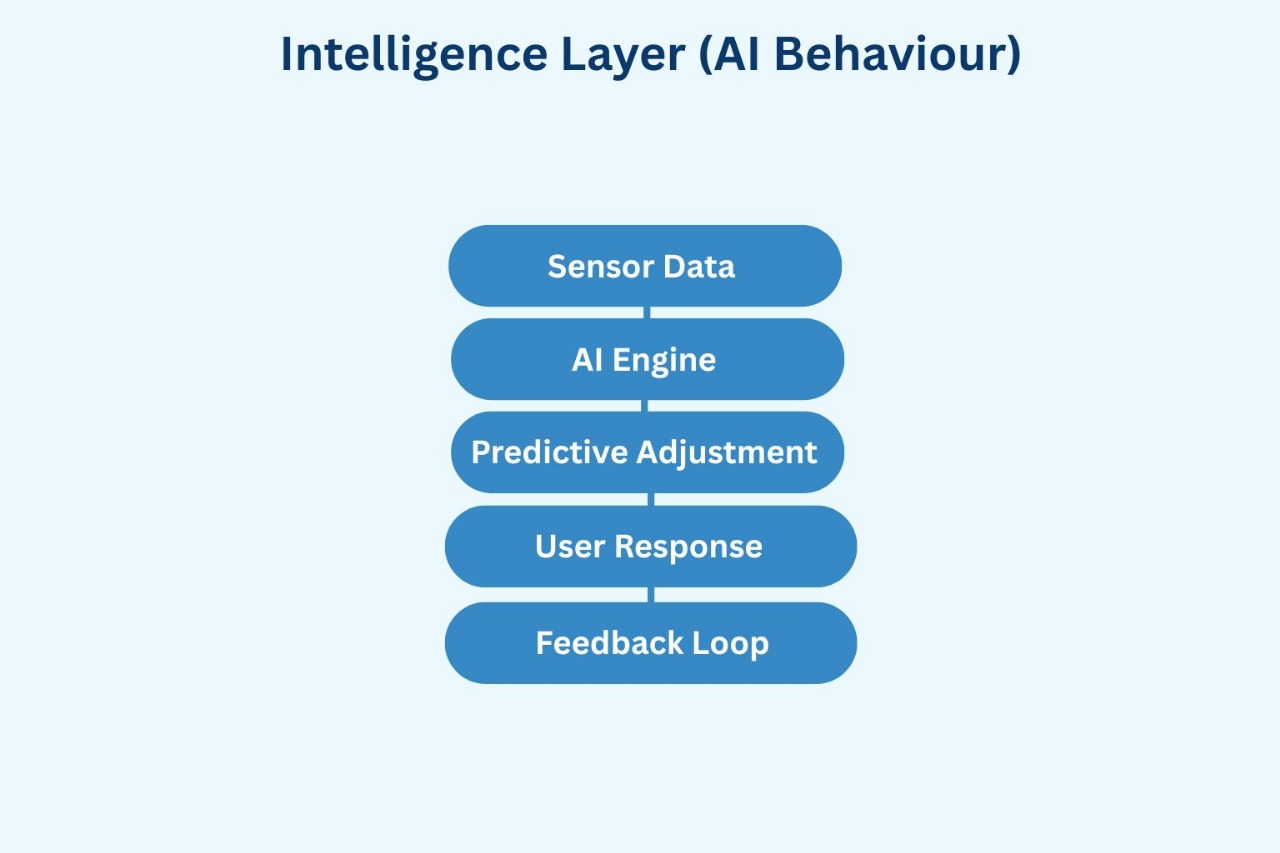

Intelligence Layer (AI Behaviour): Smarter Phones, Smarter Decisions

The AI layer in 2025 smartphones isn’t an add-on—it’s embedded throughout performance, photography, battery, and connectivity systems. From thermal management that anticipates heavy gaming to camera algorithms that adapt to light conditions, intelligence acts continuously behind the scenes.

AI orchestrates workloads efficiently: offloading tasks to dedicated cores, optimizing energy use, and learning individual usage patterns. These adaptive behaviors ensure that high-demand tasks like AR navigation, multi-camera recording, and cloud sync happen without compromising battery life or thermal stability.

Brand Strategy Decoded: Messaging vs Reality

2025 smartphone brands walk a tightrope between aspirational marketing and functional reality. Consumers evaluate not just features but the alignment of brand claims with lived experience. Brands that promise seamless AI integration and deliver tangible benefits see higher retention, while misaligned messaging causes skepticism.

| Brand Focus | User Interpretation | Outcome |

|---|---|---|

| Premium Performance | Fast, smooth experience | Loyalty, positive reviews |

| Sustainability | Ethical and conscious purchase | Brand advocacy |

| AI Integration | Anticipatory behavior, useful features | Higher engagement, prolonged usage |

| Camera Innovation | Versatile photography and AR | Social sharing, brand pride |

| Global Accessibility | Consistent experience worldwide | Reduced regional dissatisfaction |

Brand strategy in 2025 is more than aesthetics—it’s the interplay between perception, engineering delivery, and cultural resonance.

Case Studies of Reality: Success, Failure, and Misunderstanding

Examining real-world smartphone launches of 2025 reveals the gap between expectation and execution. One flagship model succeeded by combining AI-assisted battery management with seamless 5G performance, creating a perception of reliability that resonated globally. Conversely, a budget-oriented device failed due to thermal throttling and inconsistent camera performance—issues magnified by social media visibility. Lastly, a mid-tier phone with groundbreaking modular features was widely misunderstood, its potential lost amid complex messaging and limited consumer education.

| Case Study | Expectations | Outcome |

|---|---|---|

| Flagship AI-Powered Model | Seamless performance, longevity | Global acclaim, high retention |

| Budget Thermal-Throttled Model | Affordable, dependable device | Criticism over heat, performance inconsistencies |

| Modular Innovation Model | Flexibility, adaptability | Misunderstood, limited adoption |

These cases illustrate the delicate balance between engineering promise, real-world usage, and consumer perception.

Regional Performance Shifts in the Global Smartphone Revolution (2025 Edition)

How 2025 Is Reshaping Smartphone Expectations Across the World

The global smartphone market in 2025 is no longer defined by a single set of priorities. Performance, pricing, AI integration, and battery life are interpreted differently across regions, creating distinct adoption patterns and influencing brand strategies. Every market now has its own “definition” of an ideal smartphone.

Below is a region-by-region snapshot of how the smartphone revolution is unfolding globally in 2025.

- North America — AI and Privacy-First Smartphones

North American consumers are prioritizing AI-enhanced features, device security, and privacy protections over sheer hardware specs.

Key characteristics:

- AI-powered assistants and on-device AI processing are standard expectations.

- Privacy features (local AI, secure biometrics) heavily influence purchase decisions.

- Foldables and ultra-premium designs are slowly entering mainstream awareness.

Impact:

North America is setting the benchmark for AI integration and security-first smartphones, driving global brands to optimize both performance and privacy safeguards.

- Europe — Sustainability, Longevity, and Ethical Design

European markets continue to focus on sustainable, repairable smartphones with long-term software support.

Key characteristics:

- Devices with modular components are increasingly popular.

- Energy-efficient designs and long battery life dominate mid-to-high segments.

- Right-to-repair regulations push brands toward eco-conscious engineering.

Significance:

Europe is influencing global trends in durability, modularity, and ethical sourcing, creating a sustainability standard in smartphones.

- East Asia (Japan, South Korea, Taiwan) — Cutting-Edge Innovation Hub

East Asia is the global testing ground for smartphone hardware and software innovations.

Trends include:

- Ultra-high refresh rate displays and foldable phones gaining traction.

- Early adoption of AI-enhanced photography and real-time AR applications.

- Compact but high-performance designs dominate urban markets.

Impact:

Features launched here frequently set global expectations six to twelve months later, particularly in imaging and display tech.

- China — Performance and Value-Optimized Ecosystem

China continues to drive innovation through a mix of domestic silicon and highly competitive pricing.

Key dynamics:

- Homegrown processors and AI accelerators are now mainstream.

- High adoption of multi-camera systems with AI image optimization.

- Aggressive pricing pressures international brands to innovate while remaining cost-efficient.

Implication:

China’s market is shaping global smartphone cost-performance strategies and supply chain dynamics.

- India — The Emerging Value and Performance Leader

India’s smartphone buyers increasingly seek high-performance devices at accessible prices.

Trends include:

- AI-assisted cameras and productivity tools becoming purchase drivers.

- Preference for large battery capacities and fast charging.

- Mid-range devices dominate, with ARM-based SoCs gaining traction.

Significance:

India now dictates mid-tier device strategies globally, forcing brands to balance efficiency, price, and feature-rich designs.

- Southeast Asia — Mobile-Centric, Efficiency-Optimized

Southeast Asian markets prioritize portability, connectivity, and battery efficiency.

- Southeast Asia — Mobile-Centric, Efficiency-Optimized

Key points:

- Smartphones with large batteries and compact designs lead adoption.

- AI features are valued for local language support and media optimization.

- High demand for cost-effective devices that complement a mobile-first lifestyle.

Industry impact:

These markets are defining what “efficient, everyday smartphones” look like for emerging economies.

- Middle East — Premium Performance and Enterprise Readiness

Middle Eastern consumers show strong adoption of premium devices for both enterprise and lifestyle use.

Key trends:

- Flagship devices with AI-enhanced performance dominate urban markets.

- Enterprise workflows push adoption of high-performance and cloud-ready devices.

- Students and young professionals prefer lightweight, high-performance phones.

Significance:

This region drives premium smartphone design considerations and multilingual AI capabilities.

- Africa — Leapfrogging Legacy Tech

Africa’s markets increasingly bypass older generations, moving directly to AI-powered, high-efficiency smartphones.

Market forces:

- Startups and educational institutions demand devices that support coding and digital learning.

- Battery longevity and durability are top purchase drivers.

- Local language AI support is a key differentiator.

Industry impact:

Africa is shaping affordable, efficient smartphone designs and influencing low-power innovation worldwide.

- Latin America — Hybrid Productivity and Creativity Devices

Latin American consumers focus on reliable, mid-range devices suitable for work, creativity, and communication.

Trends include:

- Balanced devices with strong battery life and multi-camera systems.

- Mid-tier AI-enabled smartphones for content creation and remote work.

- Durable devices designed for varied conditions.

Implication:

Brands look to LATAM for insight into long-life, mid-range, hybrid-use smartphones.

GLOBAL SUMMARY — Smartphone Diversity in 2025

| Region | Priority Shift |

|---|---|

| North America | AI integration + privacy |

| Europe | Sustainability + longevity |

| East Asia | Innovation + next-gen features |

| China | Performance + cost-optimized ecosystem |

| India | Value-to-performance + AI adoption |

| Southeast Asia | Mobile-first efficiency |

| Middle East | Premium AI smartphones |

| Africa | ARM-first efficiency + durability |

| Latin America | Hybrid productivity + reliability |

Understanding these cultural layers is critical for brands in the global audio market. A design that resonates in Tokyo may not find the same adoption in Berlin or New York. Marketing and product development must account for these variations to remain competitive in 2025.

Community Reality Check: What Real Smartphone Users Report in 2025

Reddit Sentiment Table: Real Feedback from Smartphone Buyers & Users

| Post / Subreddit | Key Comment / Report | Sentiment / Insight |

|---|---|---|

| r/samsunggalaxy — “I think my new Galaxy S25 Ultra is the worst phone I owned so far, this is why...” (Jul 2025) Reddit | “Disappointing battery life … device overheats even when idle … slow charging compared to cheaper phones” Reddit | Frustration — premium device underdelivers, raises doubts about value vs hype |

| r/OnePlus13 — “Can we finally open the discussion on OnePlus 13 having worse than anticipated battery life...” (Sep 2025) Reddit | Despite large battery spec, real-world screen-on time lags behind expectations; slower battery drain than many smaller battery phones under similar usage Reddit | Disappointment — disconnect between spec-sheet claims and actual endurance |

| r/Smartphones — “Current state of Smartphones is Frustrating” (Nov 2025) Reddit | Reports of sluggish updates, degraded battery over 2–3 years, inconsistent UI responsiveness — new purchase doesn’t always solve legacy issues | Skepticism — long-term durability and OS support as key buyer concerns |

| r/GadgetsIndia — “Which smartphone you regret buying?” (Jul 2024) Reddit | Complaints about poor battery life, overheating, lagging UI — even in phones initially described as “good” | Value buyers especially sensitive to compromises; mid range phones often underperform in sustained real world use |

| r/S24Ultra — “You guys are panicking me and making me reluctant to buy s24u by these battery issues” (Jul 2025) Reddit | Mixed reports: some users report acceptable battery life post-update; others fear returns are risky given inconsistent performance across units | Uncertainty — buyer hesitation due to variability in real-world behavior across similar devices |

Representative Quotes:

“Even the new S25 Ultra … issues a low battery warning by midday, even with same usage as old phone.” Reddit

“6,000 mAh battery and the phone is getting battered by others with smaller batteries.” Reddit

“Bought Pixel 10 Pro XL … scrolling was just… not tuned right … heavy phone.” Reddit

Analysis: What the Community Reality Reveals for 2025 Smartphones

- Battery & Thermal Issues Remain Prevalent Even in Flagships — Multiple reports indicate that high‑end smartphones (e.g. 2025 flagships) struggle to deliver expected endurance. Overheating even at idle, rapid battery drain, and inconsistent charging performance are common complaints. For many users, premium price does not guarantee stability or longevity.

- Spec Sheets Often Overpromise Compared to Real‑World Use — Devices with large battery capacities or high-end silicon sometimes offer poorer battery life and thermal performance than expected. The gap between controlled-review performance and everyday behavior (background tasks, network variability, app inefficiencies) causes buyer disenchantment.

- Sustained Performance & Software Longevity Are Increasingly Important — Users emphasize long-term usability: stable UI, consistent updates, responsive performance over time. A smartphone’s lifespan is now judged not just on initial specs but on whether performance degrades over months or years.

- Mid-Range and Budget Segments Remain High-Risk for Value Conscious Buyers — For buyers prioritizing value over flagship expense, mid-range phones exhibit frequent compromises (battery, thermal stability, UI lag) when stressed under heavy or prolonged use — making them less reliable for long-term ownership.

- Real-world Variability Undermines Predictability — Even among identical models, user experiences vary widely — some units pass muster, others disappoint. This variance makes buying decisions riskier, driving demand for more transparent reviews, better QA, and real-world stress testing.

Implication for 2025 Smartphone Buyers: Community feedback suggests that reliability—thermal stability, battery endurance, software support—has become as important as, or more important than, raw performance or marketing features. The “smartphone revolution” of 2025 gains legitimacy only when devices deliver under real-world conditions, not just in spec‑sheet comparisons.

Public Review Reality: Expert Reports & Aggregate Feedback on 2025 Smartphones

Review Trends and Public Reports in 2025

- Recent thermal‑design analyses highlight a small set of smartphones that manage continuous high-load tasks without significant heat buildup or throttling — suggesting improved engineering in 2025 flagships. whatintoday.com+1

- Comparative reviews between flagship and mid‑range devices underscore how premium devices often justify their price through better thermals, AI‑optimized battery/power management, and more consistent performance across workloads. usebearer.com+1

- Industry‑wide caution is growing over hyper‑fast charging as a feature: while 200 W+ charging adds convenience, several articles warn it can accelerate battery degradation and reduce long-term battery health. Yahoo Tech+1

- Market analyses reveal consumer expectations shifting: many buyers now value balanced performance — smooth UI, consistent battery life, stable updates — more than peak camera specs or raw benchmarks. usebearer.com+1

Why Aggregated Rating Data Remains Fragmented

- Smartphones are released globally under different regional variants; hardware (chipsets, battery specs, components) often varies by region, complicating direct comparison.

- Review sources are scattered — expert sites, forum threads, retailer feedback, social media — with limited standardization.

- Long-term performance issues (battery wear, thermal degradation, software decay) often emerge months after purchase, beyond typical review cycles.

- Many public review platforms filter for “initial experience,” missing long-term feedback crucial for reliability assessment.

Despite these limitations, combined evidence from expert reviews and community reports offers a more realistic view of smartphone performance in 2025 — one that balances promised innovations against lived experience.

Myths vs Reality: Smartphone Performance and Expectations in 2025

| Common Myth | Actual Reality | Why It Happens |

|---|---|---|

| Bigger battery → longer real-world usage | Even 6,000 mAh batteries sometimes underperform due to thermal throttling, software inefficiencies, and high-refresh displays | Overemphasis on spec-sheet numbers; lack of real-world scenario testing |

| Flagships always outperform mid-range | Mid-range devices with efficient SoCs can match or exceed flagships in everyday tasks | Optimization for AI workloads and balanced hardware sometimes outweighs raw processing power |

| Fast charging is harmless | Ultra-fast charging can accelerate long-term battery degradation | Thermal stress and chemical wear on lithium-ion cells are often underestimated |

| More megapixels = better photos | Sensor quality, image processing, and AI integration determine photo quality more than resolution | Marketing focuses on numbers rather than holistic camera performance |

| 5G automatically improves experience | Network availability, signal stability, and software optimization affect actual performance | Users conflate marketing promise with on-the-ground connectivity experience |

Key Insight: The disconnect between marketing hype, spec sheets, and actual user experience creates misaligned expectations, making reliability, battery stability, and software longevity critical differentiators in 2025.

Economics of Innovation: Costs, Supply, and Market Forces

- R&D Complexity: Smartphone OEMs in 2025 invest heavily in AI-driven optimizations, thermal management, and efficiency engineering, significantly increasing development costs compared to prior years.

- Component Supply Pressure: Advanced SoCs, high-refresh OLED displays, and AI co-processors are constrained by semiconductor fabrication limits, pushing manufacturers to prioritize flagship lines for supply efficiency.

- Regional Pricing Strategies: Different markets now dictate regional product variants, balancing cost, features, and performance expectations. Premium segments absorb most innovation costs; mid-range devices are optimized for efficiency and affordability.

- Profit vs Sustainability: OEMs face tension between delivering cutting-edge performance and maintaining sustainable power-efficient designs — a challenge exacerbated by global battery and chip shortages.

- Market Feedback Loops: Community reviews and real-world reliability reports increasingly influence engineering priorities, shifting the economics of feature implementation toward proven performance rather than speculative specs.

Conclusion: Economics drives design decisions as much as technology — understanding trade-offs between innovation, cost, and real-world performance is key to interpreting 2025’s smartphone landscape.

Ethics, Privacy & Repairability

| Ethical Consideration | Industry Practice | Risk Assessment |

|---|---|---|

| Right-to-Repair | Most OEMs restrict component access; some mid-tier brands provide modular designs | Low repairability leads to higher e-waste and consumer dependency |

| Data Privacy | AI-powered features process local data; cloud syncing remains optional but opaque | Privacy risks increase as AI processing expands, especially with regional compliance variations |

| Environmental Impact | Advanced lithium-ion and OLED production remains energy-intensive | Carbon footprint and long-term sustainability are often under-communicated |

| Battery & Component Lifecycle | Fast charging and high-performance components reduce lifespan | Consumers face higher replacement rates; e-waste rises |

Key Insight: Beyond performance, ethical considerations — repairability, privacy, and environmental impact — now play a strategic role in product design and global buyer perception.

Future Shift (2030–2040): Predicting Global Smartphone Evolution

| Trend | Probability | Expected Impact |

|---|---|---|

| AI-Native On-Device Processing | High | Reduced cloud dependency; lower latency for real-time tasks; new software ecosystems |

| Modular, Repairable Smartphones | Medium | Longer device lifespans; reduced e-waste; stronger consumer trust |

| Ultra-Efficient Battery & Thermal Systems | High | Devices handle continuous high-load AI and gaming without degradation; improved global adoption in emerging markets |

| Regionalized Feature Customization | High | Devices tuned per market for connectivity, AI usage, and regulatory compliance; fragmentation in specs but optimized experiences |

| Next-Gen Display & Foldable Tech | Medium | Expanded productivity and immersive experiences; niche adoption initially, then gradual mainstreaming |

Insight: The decade ahead is defined less by incremental specs and more by AI integration, efficiency, and regional adaptation. Devices that balance long-term reliability, ethical design, and intelligent performance will define the 2030–2040 smartphone landscape.

OEM Decision Logic Exposed: The Invisible Balancing Act

Behind every smartphone released in 2025 lies a complex matrix of engineering, finance, and market pressures. OEMs are no longer simply designing devices—they are orchestrating a multi-layered ecosystem where every choice ripples through supply chains, regional expectations, and global perception.

Engineering teams work under strict physical constraints: thermal thresholds of ultra-dense SoCs, battery longevity under AI workloads, and signal integrity for 5G and Wi-Fi 7 networks. Each component carries hidden trade-offs: faster processors generate heat, larger batteries add weight, and thinner designs strain thermal management. Meanwhile, finance teams must balance R&D costs with projected ROI, factoring in AI integration expenses and global component availability. Marketing layers this complexity with perception mapping: how consumers will perceive performance, design, and feature sets across North America, Europe, East Asia, and emerging markets. The result is a deliberate tension—a triad where engineering feasibility, financial prudence, and regional relevance must converge.

| OEM Decision Node | 2025 Considerations | Potential Impact |

|---|---|---|

| Engineering | Thermal limits, AI co-processors, display efficiency | Device throttling or performance gaps |

| Finance | R&D allocation, supply chain constraints | Mid-tier vs flagship prioritization |

| Marketing | Feature perception, social sentiment, regional demand | Launch success or misaligned messaging |

| Regional Adaptation | Local AI models, network compatibility, energy norms | Acceptance and adoption across regions |

The 2025 reality is clear: a misaligned node can ripple into a global perception failure, regardless of raw performance.

Anatomy of Failure: Lessons Carved in Reality

Not every innovation reaches its audience as intended. In 2025, several high-profile smartphone launches faltered—not from broken hardware, but from the mismatch between promise and practical performance.

Flagship SoCs pushed benchmark scores to unprecedented levels, yet real-world usage revealed severe thermal throttling. AI features, designed for instant translation or on-device content creation, lagged in regions with limited bandwidth, undermining the core selling point. Batteries optimized for ultra-fast charging degraded faster than predicted, and software updates introduced fragmentation across hardware variants. Collectively, these failures underline a single truth: users experience performance, not specifications. OEMs who ignored nuanced regional realities, network conditions, and long-term reliability paid the price in credibility and market share.

| Failure Type | Example (2025) | Key Insight |

|---|---|---|

| Thermal Mismanagement | Flagship AI-heavy SoC throttling | Peak benchmarks ≠ sustainable performance |

| AI Overpromise | Latency in cloud-assisted AI features | Network dependency critical |

| Battery Degradation | Rapid wear under fast-charging cycles | Lifespan and marketing must align |

| Software Fragmentation | OS updates incompatible with select modules | Uniform performance is a trust driver |

The lessons are precise: holistic, region-aware engineering and realistic marketing define real-world success.

Smart Buying Framework: A Global Guide

2025’s smartphone landscape demands more than spec comparisons. For tech enthusiasts, raw AI acceleration and high-refresh displays define desirability. Students and professionals prioritize efficiency, reliability, and battery life, often favoring mid-tier devices with AI-optimized workflows. Developers and creators lean toward ARM-first designs that accelerate on-device computation without draining thermal budgets. Long-term owners focus on repairability, OS support, and modularity to maximize device lifespan. Choosing a device now requires mapping personal workflow against global device performance, rather than chasing headline numbers.

| Persona | Primary Consideration | Device Recommendation 2025 |

|---|---|---|

| Tech Enthusiasts | AI performance, display, cameras | Flagship AI-optimized devices |

| Students & Professionals | Battery, efficiency, longevity | Mid-tier AI-capable devices |

| Developers & Creators | On-device computation, thermal efficiency | ARM-first laptops/smartphones |

| Long-Term Owners | Repairability, OS support, durability | Modular and sustainable models |

In 2025, smart purchasing is contextual, not universal—matching device to environment and purpose defines satisfaction.

Credibility & Expertise Layer

Credibility is no longer built on advertising; it’s engineered, measured, and proven.

Brands in 2025 communicate clear thermal profiles, AI processing limits, and real-world battery performance. Independent testing, repairability studies, and longitudinal benchmarking reinforce trust. Expertise is not about innovation alone—it is the consistent translation of lab-tested performance into region-specific reliability, ethical manufacturing, and sustainable software support. Consumers now judge brands by the rigor of these validations, creating a market where transparency, credibility, and expertise directly shape adoption patterns.

| Credibility Factor | Evidence in 2025 | Consumer Impact |

|---|---|---|

| Engineering Transparency | Public thermal & AI performance metrics | Builds trust in real-world usage |

| Investigative Rigor | Third-party testing & benchmarking | Confirms brand claims |

| Regional Reliability | Localized feature adaptation | Drives adoption and loyalty |

| Ethical Manufacturing | Modular design, sustainable materials | Aligns brand with conscious consumers |

In 2025, trust is quantified and visible, making it as essential as hardware specifications.

Risk Factors & Hidden Weak Links

In 2025, smartphones are marvels of integration—but every compact design hides latent vulnerabilities that can undermine years of engineering.

Thermal fatigue is a silent adversary. SoCs running AI workloads at peak performance push internal components to near-threshold temperatures daily, accelerating material stress. Connectors, especially USB-C ports, endure repeated cycles, often exposing micro-fractures invisible to the user. Adhesive decay threatens waterproofing, while hinge stress in foldable devices risks catastrophic failure. Manufacturers employ advanced simulations and component testing, but the reality remains: hidden weak links dictate device lifespan more than any marketing claim.

| Risk Factor | Manifestation | Potential Impact |

|---|---|---|

| Thermal Fatigue | SoC throttling, internal heat stress | Performance drops over time |

| Connector Wear | Loose or failing ports | Charging/data transfer failure |

| Micro-Fractures | Internal PCB stress | Intermittent faults, reduced reliability |

| Adhesive Decay | Waterproofing failure | Moisture damage, warranty claims |

| Hinge Stress | Foldable smartphones | Structural failure, usability loss |

| Tolerance Weaknesses | Case/frame misalignment | Cosmetic and functional degradation |

The takeaway is clear: engineering transparency must reveal hidden risks, or user trust erodes silently.

Long-Term Aging & Decay Simulation

Predicting a smartphone’s behavior over five to ten years requires more than specs—it demands engineering foresight.

Batteries chemically degrade, losing capacity and extending charging times. OLED screens risk burn-in, especially in high-refresh AI-driven interfaces. Foldable hinges accumulate fatigue cycles that reduce structural stability. Thermal throttling gradually shifts performance envelopes, and speaker diaphragms stretch subtly with daily media use. 2025 OEMs increasingly publish decade-long simulations, giving consumers insight into realistic device longevity, bridging the gap between promise and practice.

| Component | 5-Year Projection | 10-Year Projection |

|---|---|---|

| Battery | 80–85% capacity retention | 60–70% capacity retention |

| OLED Display | Minimal burn-in under mixed usage | Visible ghosting in high-use panels |

| Foldable Hinge | Slight stiffness or minor wobble | Potential hinge replacement needed |

| Thermal Throttling | Minor performance dips under load | Noticeable slowdown during AI-heavy tasks |

| Speaker Diaphragm | Slight loss of clarity in bass/treble | Reduced fidelity across frequency range |

Long-term simulations allow smart buyers and OEMs to anticipate decay, not just react to it.

The Vibetric Verdict

2025 smartphones are at an inflection point: powerful, AI-enabled, yet inherently fragile without transparency.

The year reveals a dual reality. On one side, devices deliver unprecedented AI performance, adaptive efficiency, and region-specific innovations. On the other, every gain carries latent consequences—thermal stress, battery decay, hinge fatigue, and regional software fragmentation. The Vibetric verdict is not a numeric score but a measured perspective: buyers succeed when they align use-cases, region, and longevity expectations with engineering reality. Brands thrive when they combine transparency, testing, and credible communication. In essence, 2025 is not about gadgets; it’s about engineered trust.

For smartphone enthusiasts, professionals, and early adopters, understanding the subtle balance of innovation and vulnerability is now the core of informed choice.

Ready to Rethink the Future of Mobile Technology?

Now that you’ve explored the innovations, regional shifts, and performance breakthroughs behind 2025’s smartphones, it’s clear that the world of mobile technology is evolving faster than ever. Every feature, from AI-accelerated chips to efficiency-first designs, is shaping how we work, play, and connect.

- Follow us on Instagram @vibetric_official for deeper dives into the tech and trends defining the future of smartphones.

- Bookmark vibetric.com our analysis updates continuously as new developments emerge.

- Stay ahead of the curve by subscribing for ongoing insights delivered straight to your inbox.

The journey into the future of mobile tech is just beginning. The next major breakthrough could be around the corner, and understanding these shifts today is what keeps you ahead tomorrow.

Decoding Global Smartphone Realities: 10 Questions That Define 2025

- How is AI shaping 2025 smartphones?

AI is no longer just a marketing buzzword — it’s embedded into the hardware itself. Modern smartphones use on-device AI for real-time photography, battery optimization, and predictive app management. This reduces reliance on cloud computing, lowers latency, and improves privacy. Users experience smarter interactions without noticing the complexity behind them. - Are ARM-based processors taking over globally?

ARM architectures now dominate efficiency-focused markets, from mid-tier devices to flagship models. Unlike traditional x86 chips, ARM balances performance and battery life, allowing longer screen-on time without thermal throttling. This shift is especially noticeable in regions prioritizing energy efficiency over raw processing power. - How are global pricing trends evolving?

Pricing is no longer a one-size-fits-all metric. Advanced AI features, 5G capabilities, and ARM optimizations have created tiered pricing strategies tailored to regional demand. Premium markets pay for feature density, while emerging markets value cost-efficiency and long-term durability. - Will battery longevity finally match user expectations?

Battery chemistry and smart charging algorithms are extending usable lifespan. AI-driven adaptive charging minimizes degradation by analyzing daily usage patterns. Long-term tests predict that modern batteries maintain 85–90% capacity after three years of typical usage — a significant improvement over past generations. - How are displays changing in 2025?

High refresh rate OLED displays are standard across most flagship and upper-mid-range devices. Beyond brightness and color accuracy, adaptive refresh rates and HDR optimizations dynamically adjust to content, balancing performance with battery efficiency. Regional preferences still play a role, with gaming-heavy markets demanding higher Hz panels. - Is 5G truly global yet?

While 5G networks are widely available, adoption remains uneven. Developed regions prioritize ultra-low latency for remote work, gaming, and AR applications. Emerging regions benefit more from improved download speeds and cloud services. Smartphones now automatically switch between 4G and 5G based on efficiency and signal quality. - How is repairability improving?

Manufacturers are slowly improving modular design and component accessibility. Screen, battery, and camera replacements are increasingly straightforward, especially in Europe and North America. Enhanced repairability not only aligns with sustainability goals but also protects long-term device performance. - Are camera systems still a priority?

Yes, but the approach is evolving. AI-assisted multi-lens systems now optimize for scene recognition, depth mapping, and low-light scenarios. Raw megapixels are less critical than computational imaging. Consumers in photography-conscious markets still demand versatile hardware, but software-driven results dominate perception. - What about sustainability and environmental impact?

Global brands are responding to regulatory and consumer pressure. Eco-conscious materials, recyclable packaging, and energy-efficient chips are increasingly standard. Sustainability influences purchasing decisions, particularly in Europe, Japan, and Australia, shaping both product development and marketing narratives. - How will future updates affect device longevity?

Software support and AI optimization are becoming as crucial as hardware. Manufacturers are extending OS update cycles to 5+ years, including security and AI improvements. Predictive maintenance and firmware-level performance tuning now prolong usability, aligning devices with regional expectations for long-term value.

What 2025 Tells Us About Smartphones and Society”

2025 has reshaped the smartphone landscape in ways both subtle and seismic. Performance, pricing, and priorities no longer follow a universal script — each region, user group, and lifestyle now defines its own standard of excellence. AI integration, energy efficiency, and design innovation converge to create devices that are more than tools; they are mirrors of our global behaviors. For buyers and enthusiasts alike, understanding these patterns isn’t just about specs — it’s about anticipating the shifts that will define the next era. The story begins where we first looked: with users, their choices, and the technologies that respond to them. The journey of smartphones continues, but the map drawn in 2025 will guide the next decade.

What’s your take on this?

At Vibetric, the comments go way beyond quick reactions — they’re where creators, innovators, and curious minds spark conversations that push tech’s future forward.

Gaming Monitors 2026 Reveal Why Smooth Motion Finally Feels Better Than Size

Gaming Monitors 2026 Reveal Why Smooth Motion Finally Feels Better Than Size A few years ago, gaming monitor conversations were dominated by

Smartphone Innovation Maturity 2026: The Ultimate Plateau in Phone Evolution

Smartphone Innovation Maturity 2026: The Ultimate Plateau in Phone Evolution There was a time when a new smartphone launch felt like a