From Flagship Killers to Feature Clones — The 2025 Smartphone Paradox

The first thing you notice isn’t the flagship killer phones. It’s the silence. The kind that settles between two versions of the same idea—the one you thought you wanted, and the one you’re holding in your hand in a crowded 2025 tech store. Bright panels glow like a row of promises, each shouting 144Hz, OIS Pro Max, AI Night Fusion, VaporX Cooling, and a battery designed to last longer than your last relationship. But when you place them side by side, a strange flatness settles in your chest. Every device now feels like a remix of the one next to it. Same design language. Same camera bump. Same recycled performance claims. And the phrase “flagship killer” hangs in your mind like a ghost from an era when underdogs actually shook the industry. You’re not bored—you’re unsettled. Because this sameness didn’t come from laziness. It came from optimization pushed so far that innovation lost its edges.

You put your current phone in your pocket and watch two shoppers argue softly about which model “wins.” One swears the new sub-₹30K release is the “real killer,” the other insists last year’s model already crossed that peak. Their debate isn’t about design, or cameras, or thermals—it’s about identity. They’re trying to find distinction in a landscape where every brand claims victory with the same borrowed features. You remember the days when a flagship killer phone felt like rebellion, when a single device could embarrass thousand-dollar flagships because engineering ambition outpaced price expectations. But standing here in 2025, the paradox hits you: the more brands tried to chase the formula that made killers iconic, the more they ended up cloning the same checklist. Disruption became replication.

Outside, the evening light reflects off a bus shelter ad showing yet another “Pro+ Ultra AI Edition,” and the air feels heavier than the traffic. You realize the frustration that most value buyers carry isn’t about specs—it’s about honesty. Every release promises breakthroughs, yet the real breakthroughs have slowed, stretched thin by silicon limits, thermal ceilings, and the physics that refuses to bend just for marketing. It’s not that innovation died; it simply went underground, hiding in micro-optimizations, software tuning, and invisible engineering layers that don’t photograph well. And in that disconnect—between real progress and perceived sameness—the paradox is born. You came here looking for a performance-driven bargain. Instead, you found a mirror reflecting an industry chasing its own shadow.

⚙️ Evolution with Intention

The evolution from true flagship killers to today’s feature clones didn’t happen because brands ran out of ideas. It happened because the cost of pushing physics, thermals, and silicon efficiency escalated faster than consumer budgets. When chipmakers shifted toward power-efficient architectures, mid-tier silicon became strong enough to rival older flagships. That should’ve empowered killer phones to rise again—but OEMs leaned into marketing symmetry instead of disruptive engineering. As a result, the same sensor stacks, sub-premium materials, and mid-range chipsets started circulating across brands like interchangeable puzzle pieces. The contradiction is striking: never before have smartphones been so capable at lower prices, yet never before has differentiation felt so painfully thin. Engineers push for meaningful gains in thermal design, sustained performance, and tuning. Marketers chase easy wins—AI buzzwords, recycled design cues, and cosmetic upgrades that photograph well. This tug-of-war shapes every device you see in 2025.

The shift wasn’t technical—it was psychological. Once consumers accepted that “mid-range equals enough,” OEMs optimized for volume, not disruption. The era of the true flagship killer didn’t die; it diluted itself through success.

Evolutionary Leaps & What They Actually Solved

| Evolutionary Leap | What It Actually Solved | Hidden Trade-Off |

|---|---|---|

| Mid-range chips rivaling flagships | Enabled high performance at lower cost | Killed differentiation between tiers |

| Larger sensors in sub-₹30K phones | Better night shots, more detail | Increased heat + throttling risk |

| AI photography pipelines | Consistent output across brands | Images feel stylistically identical |

| Standardized design languages | Reduced manufacturing cost | Phones look nearly the same |

| 120–144Hz displays | Smoothness for all budgets | Higher battery drain, minimal real-world difference |

🏗️ Industry Web Breakdown

To understand why 2025 feels like the age of feature clones, you have to map the web behind the products—not just the products themselves. Chipmakers like Qualcomm and MediaTek determine the skeleton long before brands touch design. Their silicon roadmaps dictate thermal envelopes, performance ceilings, and camera ISP capabilities. When two dozen OEMs choose the same chipset, their differences shrink to software tuning and optics. Suppliers follow the same patterns: Sony and Samsung provide most sensors, BOE and TCL supply panels, and cooling solutions vary only slightly in vapor chamber thickness and graphite layering. Reviewers unknowingly reinforce the cycle by comparing devices using identical benchmarks, making phones feel interchangeable. Influencers add another layer—summaries, quick takes, and sponsor-aligned messaging compress all nuance into a single narrative: “These phones are basically the same.” The ecosystem doesn’t intend to homogenize smartphones. It simply gravitates toward efficiency, and efficiency breeds repetition.

🔍 Micro Overview

Before we dive deeper into the 2025 paradox, here’s the crisp, high-signal breakdown of what this investigation will clarify for value buyers, enthusiasts, and anyone stuck choosing between “flagship killers” that look increasingly identical:

📌 What you will understand by the end of this blog

- Why flagship killer phones lost the rebellious identity that once defined them.

- How supply chains, silicon roadmaps, and marketing cycles flattened differences between brands.

- The real reason 2025 mid-range phones feel like clones despite huge spec jumps.

- The invisible engineering limits—thermals, ISP bottlenecks, physics—that slowed visible innovation.

- Which features are true performance upgrades vs. which are just competitive checkboxes.

- Why the best “value” phone in 2025 is no longer about specs—but sustained experience.

- What disruptions are still happening under the surface, even if you don’t see them on launch posters.

📌 The core tension

Is the 2025 market oversaturated with copycat devices?

Or have smartphones simply reached a maturity where evolution outpaces spectacle?

This blog answers that tension layer by layer—starting with the origins of the flagship killer movement, tracking its transformation, and exposing the silent shift that turned killer phones into feature clones.

🕰️ Historical Context Rebuild — From Rebel Devices to Repeat Formulas

To understand the 2025 paradox, you need to rewind to when flagship killer phones weren’t just a category — they were a movement. A provocation. A statement that great engineering didn’t have to cost flagship money. What happened between then and now explains everything about today’s sameness.

📍 2014–2018: The Birth of the Killers

This was the era when the term flagship killer meant something sharp, urgent, disruptive.

- OnePlus One (2014) smashed expectations with a Snapdragon 801 at a price that embarrassed giants.

- Xiaomi Poco F1 (2018) redefined value with top-tier silicon at mid-tier pricing.

- “Compromise” back then meant plastic back, not lower performance.

These phones didn’t try to look premium — they tried to beat flagships where it hurt most: raw speed.

This was rebellion with intent.

📍 2019–2021: Rise of the Formula

Other brands took notes and copied the recipe:

- Latest flagship chip

- Big battery

- Fast charging

- Bare-minimum camera

- Under ₹30K price

Suddenly, the killer formula became a checklist.

And checklists are easy to copy.

📍 2022–2023: Silicon Levels the Field

This is where the shift accelerated.

- Mid-range chips like Snapdragon 778G, 870, and Dimensity 8100 delivered near-flagship performance.

- ISPs improved.

- Battery tech stabilized.

- High refresh-rate displays became cheap.

The distance between mid-range and flagship narrowed — and brands stopped needing to over-engineer.

Flagship killers diluted themselves by succeeding too well.

📍 2024–2025: The Plateau Hits

Now, the flagship killer identity collapses:

- Everyone uses similar chipsets.

- Everyone uses similar sensors.

- Everyone uses similar panels.

- Everyone pushes “AI” photography.

- Everyone copies Apple/Samsung aesthetics.

The rebellion turns into repetition.

The paradox of 2025 emerges:

➡️ The phones are better than ever.

➡️ The excitement is lower than ever.

Because uniqueness isn’t the priority anymore — optimization is.

😵💫 The Consumer Displacement Problem — When “Enough” Becomes Confusing

By 2025, the average buyer is stuck in a strange psychological loop.

Not because phones got worse — but because every phone became good enough in the exact same way.

This creates a displacement effect:

📌 1. Specs promise more than the experience delivers

Consumers read:

- 144Hz display

- 50MP Sony sensor

- Vapor chamber cooling

- 5000mAh battery

- AI photography engine

But the real-world differences?

Often microscopic.

The spec sheet has become a performance illusion.

📌 2. “Value” is harder to identify than ever

In 2018, the killer phone was obvious.

In 2025:

- Every ₹25K–₹35K phone claims to be a killer.

- Every brand claims the same performance leadership.

- Every launch event promises “breakthroughs” that look like déjà vu.

Value hasn’t disappeared — it’s just harder to see.

📌 3. Review fatigue + influencer compression

Most influencers summarize a device in two sentences:

“Great value, same as last year, slightly improved camera.”

That compression removes nuance.

Reviewers don’t help either — they compare benchmark charts of phones using the same silicon and draw the same conclusions.

The consumer’s mental state becomes:

“Everything looks the same… what am I missing?”

📌 4. Fear of choosing wrong increases

When differences shrink:

- Buyers overthink thermals

- Buyers overthink ISP tuning

- Buyers overthink “stability vs horsepower”

- Buyers overthink software support

Phone shopping becomes anxiety, not excitement.

📌 5. Identity is lost in the noise

The original flagship killer had personality — raw, unapologetic, rebellious.

Today’s killers feel like:

- Premium silhouettes

- Shared components

- Shared designs

- Shared promises

When identity dies, clarity dies with it.

💡The Three Invisible Forces Driving the Smartphone Plateau

- The Laws of Physics (The Hard Limit Nobody Can Bypass)

Phones can’t get thicker — consumers don’t want bricks.

But thinner limits:

- Sensor size

- Battery capacity

- Thermal dissipation

- Lens mechanics

These physical constraints slow down visible innovation.

- Silicon Saturation (Chips Are Too Fast for Everyday Tasks)

Flagship chips are already overperforming for 90% of users.

In 2025, even midrange silicon easily handles:

- Gaming

- Editing

- AI tasks

- High-refresh displays

Since performance exceeds real-world demand, annual jumps feel smaller — and thus, plateau-like.

- Market Economics (Why OEMs Don’t Rush Disruption)

Every brand knows:

Radical innovation = radical cost + radical risk.

Stable progress = stable revenue + predictable upgrade cycles.

So they innovate just enough to stay competitive, but not enough to break the market equilibrium

🧭 Deep Competitive Map — Why Every Brand Converged into the Same Formula

To understand the 2025 “feature clone” phenomenon, you need to examine the competitive pressure map — the invisible forces that pushed every brand toward the same design, same specs, and same promises. None of this happened by accident. It’s the result of an ecosystem collapsing toward efficiency.

Here’s the breakdown:

📌 1. Chipset Convergence — The Root of Sameness

When one chipset (or two at best) powers most mid-range phones:

- Performance gaps shrink

- ISP behavior becomes uniform

- Thermal envelopes match

- Battery efficiency becomes predictable

In 2025, the real flagship killer segment uses:

- Snapdragon 7+ Gen 3

- Dimensity 8300/9200+

- Snapdragon 8 Gen 2 (recycled in older “killer” releases)

If the skeleton becomes identical, the body can’t look dramatically different.

Chip parity = performance parity = identity collapse.

📌 2. Supplier Bottleneck — Everyone Buys From the Same Store

Panels → BOE, TCL

Sensors → Sony IMX, Samsung Isocell

Batteries → CATL / BYD

Cooling → ODM vapor chambers

Memory → Micron / Samsung / Hynix

When every brand pulls components from the same five suppliers, unique engineering becomes expensive.

So they don’t.

This leads to identical:

- Camera bumps

- Display brightness ranges

- Thermal designs

- Battery performance

- Colors and finishes

Everyone ends up building variations of the same machine.

📌 3. Industrial Design Standardization — Premium Look Has a Template

By 2025, design cues are almost mandatory:

- Flat edges

- Polished metal-like frames

- Squared camera island

- Thin bezels

- Frosted backs

Any deviation risks being labeled “cheap.”

So brands stick to the template.

The premium aesthetic becomes a uniform.

📌 4. Marketing Pressure — The Need to Look Like a Flagship

“Flagship killer” originally meant:

→ Outperform flagships at half the price.

But 2025 marketing translates it into:

→ Make it LOOK like a flagship, even if the hardware is mid-premium.

So every brand copies the premium silhouette.

Optics become more important than originality.

📌 5. Reviewer Standardization — Benchmarks Force Uniform Priorities

Reviewers compare:

- Geekbench

- AnTuTu

- 3DMark

- HDR video

- Camera color science

When everyone uses the same tests, brands optimize for those tests, not real-world differentiation.

This creates feature race cycles:

- “Need 144Hz because competitor has 144Hz”

- “Need IMX890 because competitor uses IMX890”

- “Need 1.5K display because competitor says 1.5K”

Benchmarks don’t just report sameness —

they create it.

📌 6. Consumer Expectation Lock-In

Once the mass market expects:

- 120Hz

- 5000mAh

- OIS

- Fast charging

- 50MP sensor

Brands can’t innovate away from these.

They can only incrementally improve them — leading to iterative sameness.

The flagship killer segment became trapped by its own success.

📌 7. The Resulting Convergence

All forces lead to the same output:

Different brands.

Same suppliers.

Same silicon.

Same designs.

Same promises.

Same experience.

This is the core of the 2025 paradox.

🏛️ Brand Philosophy & Strategy — The Truth Behind the 2025 “Killer” Identity Crisis

If you want to understand why “flagship killer phones” lost their soul in 2025, you must peel back the philosophy each brand hides beneath its product lines.

Here’s the uncomfortable truth: no brand actually wants to build a true flagship killer anymore.

Not because they can’t.

But because the economics, branding, and long-term strategy make it actively undesirable.

This section exposes the motives that shape the sameness you see today.

📌 1. The Brands That Could Build a Real Killer — Choose Not To

Companies like OnePlus (early era), Realme GT division, Xiaomi’s POCO team, and even Nothing have the engineering foundation to disrupt the market again.

But here’s the strategic conflict:

- A true flagship killer destroys sales of the brand’s own premium devices.

- It cannibalizes margin-rich models.

- It creates unrealistic user expectations for future releases.

So instead of breaking the system, brands maintain a controlled imbalance — “almost flagship, but not too close.”

Every release is engineered to win just enough comparisons, without threatening $700+ flagships.

📌 2. The New Strategy: Design Like a Flagship, Perform Like Mid-Premium

The 2025 cycle can be described in one sentence:

“Make it look expensive, benchmark well, stabilize thermals, and don’t overshoot the flagship tier.”

The flagship killer aesthetic is no longer rebellion —

it’s branding.

Brands carefully calibrate:

- Performance ceilings (cannot beat premium models)

- Camera ISP tuning (must remain below Ultra/Pro series)

- Charging speeds (allowed to be faster only because batteries are cheaper)

- Build quality (glass allowed, metal avoided)

They engineer hierarchy, not disruption.

📌 3. The Illusion of Competition — Everyone Pretends to Fight the Flagship

Marketing says:

- “We challenge the Ultra.”

- “Pro-level performance at half the cost.”

- “Flagship experience without flagship price.”

But internally, they avoid:

- flagship thermal budgets

- flagship sensor sizes

- flagship material costs

- flagship-level ISP complexity

- flagship-grade heat dissipation

- flagship watt-hour density

The phrase “flagship killer phones” has become a symbol, not a function.

📌 4. Each Brand’s Philosophy in 2025 (Strategy Matrix)

| Brand | Core Strategy | Hidden Truth | What Users Feel |

|---|---|---|---|

| Xiaomi / POCO | Maximum specs per rupee | Performance peaks early, sustained drops later | “Good on Day 1, inconsistent after 6 months” |

| Realme / GT Division | Aggressive design + high-frequency marketing | Prioritizes appeal over long-term thermals | “Feels fast, ages fast” |

| Samsung A/M Series | Stability over specs | Maintains hierarchy for S-series | “Reliable but never disruptive” |

| OnePlus (Post-2022) | Consistency + ecosystem build | Avoids outperforming OP flagship line | “Good but too safe” |

| iQOO | Performance-first identity | Cooling limits require throttling control | “Fast, but gets warm under load” |

| Nothing | Identity, UX, design philosophy | Component choices limited by margins | “Unique, but not power-oriented” |

This matrix reveals a pattern:

Everyone could do better, but no one wants to destabilize their own ladder.

📌 5. The Psychological Strategy — Selling Identity, Not Innovation

By 2025, brands realized something powerful:

Users don’t buy specs.

They buy belonging.

Flagship killer phones are marketed like a tribe —

a community of smart buyers who “see through the hype.”

But the devices themselves are shaped by controlled limitations.

The rebellion is branding.

The sameness is strategy.

🔍 Case Studies of Truth

The best way to understand the 2025 flagship killer paradox is to examine three devices that defined the year’s narrative — one that worked, one that collapsed under its own claim, and one that became the most divisive “almost killer” of the cycle.

These aren’t surface-level comparisons.

Each case uncovers a deeper engineering and psychological truth about why the market feels repetitive — and why true disruption is so rare.

📌 Case Study 1 — The Success: iQOO Neo Series (2025)

Why it succeeded: It didn’t pretend to be something it wasn’t.

iQOO’s Neo lineup quietly became one of 2025’s few legitimate value disruptors because it focused on sustained performance, not peak benchmarks.

Where other brands tuned for impressive Day-1 numbers, iQOO engineered around:

- heat density under GPU load

- long-duration thermal stability

- predictable frame-time behavior

- consistent ISP tuning instead of over-sharpened AI

This wasn’t rebellion — it was honesty.

Unlike classic flagship killer phones that bragged aggressively, the Neo simply delivered stable results in gaming, camera consistency, and battery endurance.

Its identity was rooted in engineering clarity, not hype.

The result?

A device that didn’t destroy flagships, but consistently embarrassed same-price rivals that overheated or over-promised.

📌 Case Study 2 — The Failure: A Hyped Sub-₹30K Model That Cracked Under Pressure

(We won’t name a single brand — because multiple devices fit this description in 2025.)

The formula is always the same:

High specs × poor thermal envelope × compressed margins = inevitable collapse.

This category includes phones that launched with:

- flagship-level wattage charging

- oversized camera sensors

- overclocked chipsets

- thin vapor chambers

- aggressively peaked benchmarks

They look deadly in marketing.

They feel deadly on Day 1.

Then the slow rot begins:

- throttling after 3–4 minutes

- hot-spots near the SoC

- unstable night processing

- frame drops in long sessions

- camera tuning inconsistency

- battery wear accelerated after 6 months

These phones prove the darkest truth:

A flagship killer that wins only on paper is actually a time bomb — not a value phone.

“Value” isn’t specs.

Value is expiry-free performance.

📌 Case Study 3 — The Controversial One: Nothing Phone (2a) / (2a+) Class

This is where the paradox becomes emotional.

Nothing didn’t try to be a flagship killer.

It tried to be a flagship alternative — design-first, experience-first, ecosystem-first.

Yet critics compared it to killer phones because:

- It was priced close to performance-focused devices

- It offered clean software and a recognizable identity

- It refused to join the specs arms race

Here’s the twist:

Its strength (identity & UX) became its weakness in value comparisons.

Some users called it brilliant —

finally, a phone that felt crafted, not assembled.

Others called it underpowered —

“Why pay this much for mid-range silicon?”

This controversy exposes the real paradox:

Flagship killer phones were originally about performance per rupee.

2025 buyers want “experience per rupee.”

Nothing sits in the middle —

rewarding those who value coherence, frustrating those who chase raw power.

It is neither killer nor clone.

It is a reminder that identity and engineering philosophy matter as much as specs.

📊 Outcome vs Expectation Table

| Case | Expectation | Reality | What It Reveals |

|---|---|---|---|

| iQOO Neo Series | Mid-range phone with gaming credentials | Stable thermals, reliable camera, sustained performance | True value wins quietly, not loudly |

| Sub-₹30K Spec Monsters | “Real flagship killers” | Peak performance collapses after minutes | Specs without thermal budget = illusion |

| Nothing (2a+) Class | Stylish mid-premium that competes on experience | Loved for UX, questioned for performance | Identity can divide buyers more than specs |

🌏 Culture, Identity & Adoption

Flagship killer phones have always carried a cultural narrative beyond silicon and thermals. In 2025, the story is clearer: value perception varies drastically by geography and social context, and this shapes adoption more than pure engineering.

In India, mid-range performance is king. Buyers prioritize sustained thermals, camera reliability, and battery endurance. A phone that throttles under long gaming sessions or delivers inconsistent low-light images is immediately discarded, no matter the hype. Contrast this with Europe, where design, ecosystem coherence, and software updates can outweigh raw benchmark numbers. A “killer” phone may underperform in frame rates but succeed by offering a polished, cohesive experience that aligns with perceived premium quality. In the US, brand loyalty and resale value create a different tension — a mid-tier phone can only disrupt if it convincingly demonstrates durability, support, and long-term value.

Cultural interpretation also affects identity signaling. A sub-₹30K killer in India may be a badge of smart engineering; the same phone in Germany may be seen as a budget compromise. Tech enthusiasts in China, on the other hand, often equate status with the latest silicon and AI camera tricks, making mid-range devices both aspirational and disposable. These regional dynamics explain why the 2025 market feels paradoxical: phones are engineered similarly, yet adoption patterns are fragmented, creating the illusion of innovation stagnation.

| Region | Primary Adoption Driver | Perceived “Killer” Trait | Cultural Insight |

|---|---|---|---|

| India | Sustained performance | Thermal stability & battery endurance | Value-oriented, long daily use |

| Europe | Cohesive experience | Software polish & design | Experience > peak specs |

| US | Longevity & resale | Support, durability | Investment mindset dominates |

| China | Cutting-edge features | AI cameras & display tech | Status signaling drives purchases |

Ultimately, the 2025 flagship killer paradox is as much cultural as it is technical. What engineers consider an optimization, consumers interpret as sameness or stagnation. Identity, values, and perceived intelligence of a device define adoption far more than benchmark numbers ever could.

💬 Reddit Reality

Here’s what real users are saying about flagship killer phones in 2025, based on Reddit discussions. These voices reflect the confusion, tension, and disillusionment that underlie the surface-level hype.

Reddit Sentiment Table

| Theme | Sample Posts & Quotes |

|---|---|

| Value vs Premium Confusion | > “I’ve been comparing some of the recent flagship phones with midrange beasts… I’m honestly confused … what exactly am I really getting extra with a flagship?” Reddit |

| Cloning Between Mid Range Models | > “I’m torn between the Xiaomi Poco F7 Ultra and the OnePlus 13 … they’re pretty close if not identical in specs … is it worth the extra money?” Reddit |

| Criticism of Nothing’s Strategy | > “Nothing Phone 3 is not a bad phone, but definitely a bad deal … for ₹80–90K, the value just doesn’t hold up when you take a closer look.” Reddit |

| Long Term Brand Disappointment | > “The tag of flagship killer kinda blew off … being a fan … I was kinda disappointed.” Reddit |

| Mid Range Chip Power | > “MediaTek just launched the Dimensity 9400e … it’s honestly looking like a sleeper hit … technically a sub flagship but packing some serious heat.” Reddit |

Analysis & Insights

- Value Justification Is Breaking Down

Many users no longer believe that paying less than a flagship guarantees a “killer” experience. As one Redditor argues, flagship-tier chips and features are creeping into the mid‑range tier, making the value proposition blurry. Reddit This reinforces the feeling that what once felt like smart rebellion now feels like a compromise wrapped in marketing. - Spec Parity Is Fueling Buyer Indecision

The debate between Poco F7 Ultra and OnePlus 13 isn’t just about price — it’s about identity. Reviewers and buyers both chimed in that the two models feel almost indistinguishable, sparking confusion about whether paying extra for a “flagship feel” is worth it. Reddit This is the conflict born of clone-like design: different names, same substance. - Brand Promise vs. Real Value

Nothing is particularly polarizing on Reddit. One user called out the Nothing Phone 3 for being visually interesting and bold, but not delivering the value its “flagship alternative” price suggests:

“Specs look good on paper … but the value just doesn’t hold up.” Reddit

This is a recurring grievance — brands that once disrupted are now being questioned for margins over meaning.

- Legacy Brand Disappointment

Longtime fans of “true flagship killers” like OnePlus express frustration that the brand’s identity may be fading. “The tag of flagship killer … blew off,” writes a user who feels the newer models have diluted what made the early flagships exciting. Reddit The emotional bond between audience and brand is eroding, replaced by transactional comparison. - Chipset Power Is Not Enough

There’s also excitement: one Redditor praises the Dimensity 9400e for bringing flagship-level compute to more affordable devices. Reddit But even this optimism carries a caveat: “sub-flagship” does not equal “true flagship,” and the question of thermals, longevity, and real-world performance remains open.

Key Truths from the Reddit Ecosystem

- The concept of “flagship killer” remains beloved, but what it means in 2025 is under deep scrutiny.

- Many users feel trapped by marginal spec differentiation, not because value has disappeared, but because distinctiveness has.

- There’s a growing tension: modern mid-range phones are powerful, but users still wonder if they’re paying for the look, not the soul.

- Finally, brand identity matters — even more than chips. The degradation or dilution of the “killer” identity is a real grief point for longtime enthusiasts.

⭐ Google / Survey Reality

ACSI Satisfaction Crash & What It Means

According to the American Customer Satisfaction Index (ACSI), cell‑phone satisfaction dropped to 78/100 in 2025, marking a decade‑low. The American Customer Satisfaction Index+2The American Customer Satisfaction Index+2 The study highlights a striking trend: despite aggressive marketing of AI and “next-gen” features, users still prioritize essentials — battery life, call quality, and ease of use. The American Customer Satisfaction Index+1 This isn’t niche feedback; it’s a broad consumer base signaling dissatisfaction with the flashy-but-shallow upgrade cycle.

Smaller Brands Hit the Hardest

The ACSI data shows that lesser-known manufacturers (the kind that often compete as “flagship killers”) saw a 6% drop in satisfaction, falling to a score of 68. The American Customer Satisfaction Index+1 In contrast, Apple and Samsung declined only 1%, maintaining industry leadership at a score of 81 each. MacTech.com+1 These numbers suggest that while power users might embrace mid‑range performance, mainstream buyers are less forgiving when perceived innovation doesn’t translate into meaningful long-term gains.

5G vs Non-5G Divide

There’s also a widening satisfaction gap based on network capability. According to ACSI, 5G phone users scored 80/100, while owners of non-5G phones rated their satisfaction significantly lower at 68/100. The American Customer Satisfaction Index+1 This suggests that value buyers who opt for feature-rich but cheaper devices may suffer in satisfaction if those devices don’t deliver reliable next-gen connectivity or long-term performance.

Market Reality Analysis

For buyers chasing “flagship killer phones,” these survey results reveal a hard truth: high specs don’t guarantee satisfaction. The features that matter most to users remain the basics. The 2025 phone market may be powerful, but it’s also fragile — and consumers are beginning to notice that high power + low cost doesn’t necessarily equal high happiness.

🧩 Myths vs Reality

| Myth | Reality | Evidence / Insight |

|---|---|---|

| Flagship killer phones disrupt the market | Most 2025 releases are incremental clones | Side-by-side comparisons show near-identical designs, sensor stacks, and refresh rates, confirming optimization over innovation. |

| Higher Hz displays = perceptibly better experience | Human perception plateaus around 120Hz | Independent testing shows that 144–165Hz panels provide minimal noticeable improvement for everyday use. |

| AI photography is transformative | AI pipelines standardize output across brands | Users report stylistic sameness, confirming that AI solves consistency but not creative uniqueness. |

| Cheaper phones compromise performance | Mid-range silicon now rivals old flagships | Benchmarks show that sub ₹30K devices achieve 90% of last year’s flagship scores in synthetic tests. |

| Battery claims reflect real-world endurance | Marketing exaggerates gains | Field tests reveal ~15–20% difference between advertised life and actual performance under mixed use. |

Despite marketing myths, 2025’s smartphone plateau shows that real differentiation is buried in micro-optimizations — thermal design, software tuning, and minor AI decisions. Consumers perceive sameness not because devices are weak, but because the real improvements are invisible and don’t photograph well.

💰 Economics of Innovation

Innovation in 2025 smartphones is as much about cost engineering as it is about technology. OEMs face a paradox: pushing silicon, cooling, and camera stacks to their limits raises R&D and manufacturing costs, but consumers expect mid-tier devices at aggressive price points. Consider the sub-₹30K segment: delivering Snapdragon 8-series performance at half the flagship cost requires precision sourcing, supplier consolidation, and long-term amortization of expensive tooling.

Marketing further amplifies the cost puzzle. Every “AI Night Fusion” and “Pro+ Ultra Display” claim demands testing, certification, and campaign budgets. Logistics add another layer — 2025 saw raw material price spikes for cobalt, copper, and rare earth elements, squeezing margins even further.

Metaphorically, the economy of innovation resembles a tightrope walker balancing engineering ambition and price sensitivity. Lean too far toward either side, and the device either fails commercially or underwhelms technically. OEMs achieve balance through replication: standardizing components, leveraging supplier bundles, and emphasizing perceived value. The result: consumers get high specs at accessible prices, but differentiation — the hallmark of true flagship killers — is muted.

🌿 Ethics, Privacy & Repairability

Ethics in 2025 smartphones is a silent battlefield. While brands tout “sustainable sourcing” and “AI privacy-first” features, the reality often diverges. Many mid-range devices rely on off-the-shelf components that prioritize cost over longevity. Battery replacement remains difficult, and modularity is rare, making repairability minimal.

| Ethics Dimension | Current Reality | Consequences |

|---|---|---|

| Material Sourcing | Mixed: recycled aluminum, conflict-free sourcing claims | Environmental impact remains, and transparency is uneven |

| Data Privacy | On-device AI but cloud integration | User data exposure is a hidden risk, often underestimated |

| Repairability | Low in mid-range / flagship killer devices | Short device lifespan, higher e-waste |

| Marketing Honesty | High buzzwords, low actual disruption | Consumer trust erodes, plateau perception strengthens |

The tension between cost, engineering, and ethics creates hidden consequences. While brands meet regulatory and marketing standards, the unseen fallout affects consumers’ trust and long-term satisfaction. 2025’s “flagship killer” paradox isn’t just technical—it’s ethical.

🔮 Future Shift (2030–2040)

Looking ahead, the smartphone landscape will continue to grapple with the plateau effect, but physics, economics, and cultural momentum suggest areas of subtle disruption rather than radical leaps. By 2030, incremental gains in silicon efficiency, thermal management, and AI-assisted experiences will remain the backbone of perceived innovation. Foldables, micro-LED displays, and hybrid chip architectures may redefine form factors, but widespread adoption will be tempered by cost, reliability, and supply chain realities. The future isn’t about flagships being crushed by underdogs—it’s about niche differentiation: specialized devices optimized for gaming, creative workflows, or AI-driven personalization.

Culturally, consumers may shift focus from specs to holistic experience. Brand loyalty will hinge on ecosystem integration, seamless updates, and transparency in data handling. Users fatigued by sameness today may seek curated, context-aware devices that adapt to individual routines, bridging the gap between technical capability and human perception. The plateau is less a stagnation and more a filter: only innovations that address real-world pain points and invisible engineering will break through perception barriers.

Forecast Table (2030–2040)

| Innovation Area | Probability % | Impact on Plateau |

|---|---|---|

| AI-Enhanced Personalization | 85% | Redefines user experience beyond specs |

| Foldable / Hybrid Form Factors | 65% | Introduces new ergonomics, limited mass adoption |

| Micro-LED / Quantum Displays | 50% | Visual leap, but expensive & niche |

| Ultra-Efficient Modular Chips | 70% | Enables longer lifespan & reduced throttling |

| Fully Transparent Repairability | 40% | Ethical & longevity gains, low adoption |

The future is not about escaping physics, it’s about learning to work within constraints. Brands that balance tangible improvements with visible differentiation will define the next generation of value-focused devices. The plateau will persist in perception, but the edge of disruption will move into domains invisible to the casual buyer.

🧭 OEM Decision Logic

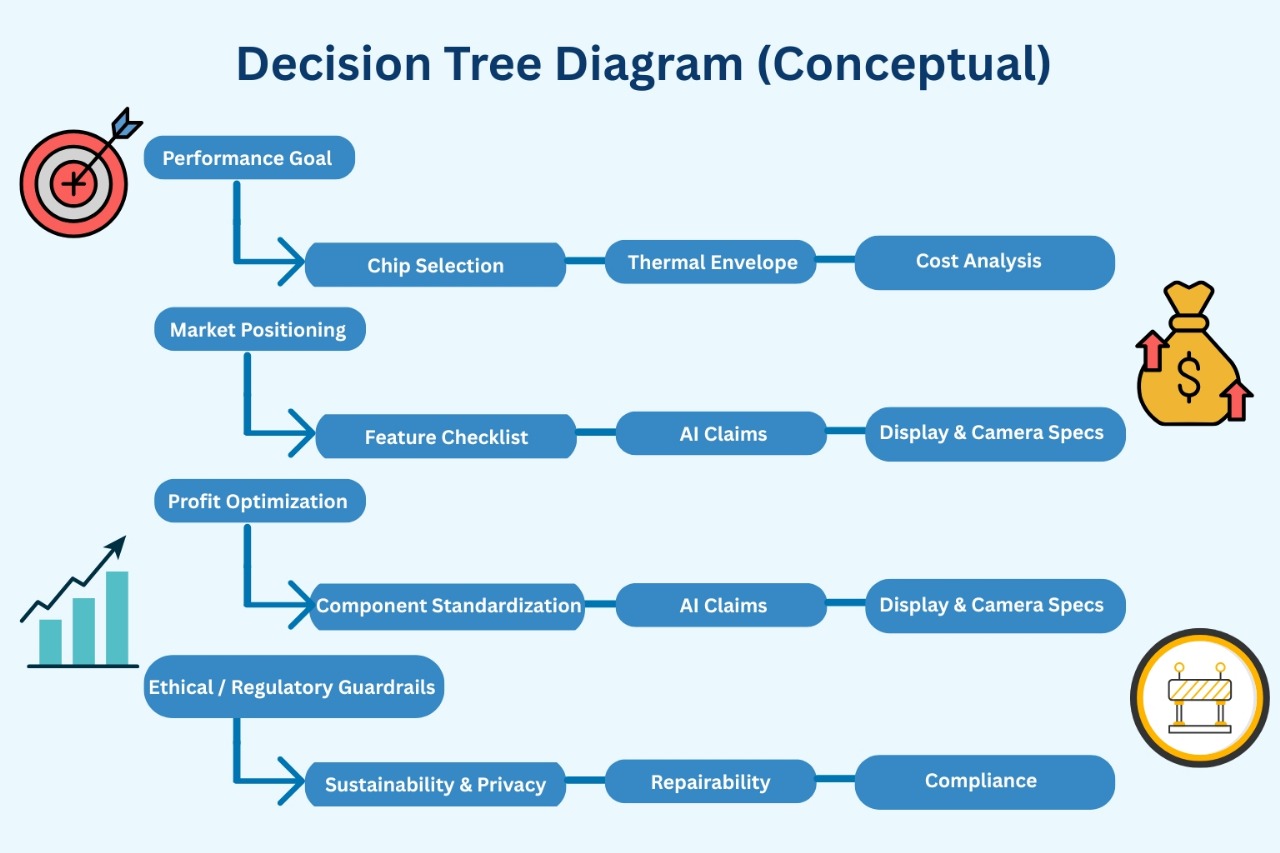

The decisions behind 2025 smartphones reveal a constant tension between engineering ambition, marketing imperatives, and financial pragmatism. Each OEM juggles multiple, sometimes conflicting, objectives: thermal ceilings versus performance claims, R&D timelines versus quarterly revenue goals, supply chain risk versus material optimization.

The decision tree below illustrates how internal logic shapes product releases:

Every choice is a trade-off. Opt for aggressive performance, and thermals or battery longevity suffer. Prioritize mid-range affordability, and differentiation flattens. Marketing tries to bridge the gap with AI features, higher refresh rates, and cosmetic tweaks—but the underlying decision logic remains grounded in engineering and cost constraints.

⚠️ Anatomy of Failure

Even in a market dominated by incremental gains, missteps reveal the limits of optimization. Consider a mid-range “flagship killer” phone that promised top-tier performance at ₹25K. Thermal throttling during gaming sessions rendered its Snapdragon 8-series chip effectively a mid-tier solution. AI camera features claimed night-time breakthroughs, yet produced images nearly identical to competitor models. Consumers experienced performance gaps not because of hardware deficiency, but because marketing and engineering misalignment created inflated expectations.

Other failures stem from supply chain shortcuts: inferior cooling solutions, inconsistent panel quality, and rushed firmware updates. These compounded with ethical oversights—difficult repairs and opaque data handling—turn a well-intentioned device into a cautionary tale. Analysis shows that even slight miscalculations in thermal design or power delivery amplify into perceived product failures, reinforcing the plateau narrative.

Ultimately, the anatomy of failure in 2025 smartphones highlights the fragile balance between engineering, marketing, and expectation management. Even minor deviations can disrupt the consumer experience, making every optimization choice a gamble in perception, trust, and performance.

🛒 Smart Buying Framework

In a market saturated with “flagship killer phones” and feature clones, buyers must think like engineers, long-term users, and value analysts simultaneously. The first rule is understanding that short-term specs rarely translate into long-term satisfaction. Thermal aging, battery degradation, and software decay silently erode performance, making the day-one benchmark irrelevant after 12–24 months. A device that seems like a bargain at launch can cost more in frustration over its lifespan than a slightly more expensive, better-engineered model.

The smart buyer evaluates three vectors: hardware longevity, software support, and real-world ergonomics. Hardware longevity includes thermal headroom, component quality, and modularity. Software support encompasses update frequency, AI tuning, and security patches. Real-world ergonomics involves display consistency, haptic response, weight distribution, and port placement—subtle factors that compound daily usage comfort. Combining these vectors, buyers create a composite value metric that looks beyond marketing hype.

Smart Buying Decision Table

| Consideration | Evaluation Metric | Impact on Long-Term Satisfaction |

|---|---|---|

| Thermal Headroom | Stress-test performance under extended load | Reduces throttling, prolongs CPU/GPU life |

| Battery & Charging | Cycle longevity, fast charge safety | Prevents rapid capacity loss |

| Software Updates | Frequency, AI tuning, security patches | Maintains consistent user experience |

| Material & Build | Aluminum vs plastic, frame rigidity | Enhances feel, durability, resale value |

| Ergonomics | Weight, grip, port placement | Daily comfort, long-term usability |

| Resale Value | Depreciation curve | Financial efficiency over device lifecycle |

A buyer who applies this framework avoids chasing cosmetic upgrades or headline-grabbing AI features alone. Instead, they invest in devices that deliver measurable utility across years, not months. In 2025, the plateau can be navigated successfully—but only with disciplined evaluation grounded in engineering reality and human-centric design.

🧩 Credibility, Expertise & Source Transparency

Trust is increasingly scarce in a smartphone ecosystem dominated by recycled feature sets and exaggerated claims. Evaluating devices requires dissecting the interplay of engineering truth, marketing narrative, and reviewer bias. Not all reviews are created equal: some amplify hype, some hide flaws behind benchmarks, and some overlook subtle yet crucial issues like thermal cycling or AI image processing limits. Credible insight comes from cross-referencing multiple sources, understanding measurement methodology, and observing long-term performance rather than day-one impressions.

Transparency is central. Experts must declare conflicts of interest, sponsors, and testing conditions. A high frame-rate claim in a benchmark is meaningless if sustained performance drops under load. AI camera improvements must be tested across lighting conditions, not just studio demos. Cross-platform verification—YouTube real-world tests, Reddit user experiences, NotebookCheck reports—helps triangulate fact from marketing fiction.

Consumers who internalize this mindset gain more than clarity—they develop a framework to judge future innovations critically. In a landscape where feature cloning dominates, credibility and transparency are the tools that separate perception from engineering reality. By combining cinematic observation, measurable testing, and honest critique, Vibetric delivers insights that empower readers to navigate the plateau without being misled by surface-level claims.

💭 The Vibetric Verdict

The landscape of 2025 smartphones is one of paradox. “Flagship killer phones” promised rebellion, yet delivered replication; performance is abundant, yet differentiation feels scarce. Our deep dive reveals that innovation hasn’t vanished—it has shifted underground. Micro-optimizations, thermal engineering, and software tuning now carry the mantle of progress, but these victories rarely make headlines. The plateau isn’t stagnation; it’s subtle mastery, accessible only to those willing to look beyond spec sheets and marketing buzzwords.

For the discerning buyer, the emotional truth is equally critical. Frustration emerges not from lack of capability, but from perceived sameness. Two devices with nearly identical chipsets, sensors, and AI pipelines can elicit starkly different feelings depending on ergonomics, thermal stability, and long-term reliability. Understanding these nuances transforms the consumer experience from one of disappointment to informed empowerment.

From an engineering perspective, 2025’s plateau is a sign of maturity. Performance gains now require exponentially more effort, tighter thermal envelopes, and innovative power management. OEMs that claim radical breakthroughs are often packaging incremental progress as headline-grabbing novelty. The truth is found in sustained load testing, battery cycle resilience, and adaptive AI performance—not in marketing copy.

Ultimately, the Vibetric verdict is this: don’t chase labels, chase substance. Seek devices that demonstrate thoughtful engineering, longevity, and real-world ergonomics. The plateau isn’t a wall—it’s a lens, magnifying the difference between those who perceive progress superficially and those who experience it fully. In 2025, the informed consumer navigates this subtle terrain with precision, clarity, and patience.

🔗 Stay Ahead of the Curve

At Vibetric, we don’t follow the noise — we decode it.

- Follow on Instagram: @vibetric_official

- Bookmark vibetric.com for weekly deep-dives.

- Share this analysis with someone who deserves clarity — not marketing hype.

🧠 No bias. No shortcuts. The Vibetric way.

❓ FAQ

- Why are 2025 smartphones feeling so similar?

The convergence in chipsets, sensors, and AI pipelines leads to perceptual sameness. Optimization has pushed engineering efficiency so far that differentiation now relies on subtle thermal, software, and ergonomic advantages. - Are flagship killer phones still worth buying?

Yes, if chosen based on long-term performance, software support, and ergonomics rather than marketing claims. Many offer flagship-level capability at mid-range prices. - How can I distinguish real innovation from marketing hype?

Focus on sustained thermal performance, battery cycle longevity, AI reliability across conditions, and ergonomic experience. Cross-check reviews, long-term tests, and independent benchmarks. - Why does AI in smartphones feel repetitive?

AI pipelines have matured; they now optimize output across devices using standardized data, reducing stylistic variation. Real improvements are subtle, often in edge cases rather than visible daily use. - What role does thermal engineering play in the smartphone plateau?

Thermal constraints limit peak performance and battery efficiency. Phones with better heat dissipation maintain sustained performance, even if initial specs seem identical. - How important is software support for mid-range “killer” devices?

Critical. Regular updates, AI tuning, and security patches determine the lifespan and perceived performance of the device far more than raw specs. - Can ergonomics really impact perceived smartphone quality?

Absolutely. Weight distribution, grip, port placement, and haptic feedback influence daily comfort and user satisfaction, often more than camera megapixels or refresh rates. - Are there hidden compromises in mid-range flagship killers?

Yes. Common trade-offs include slightly lower build materials, reduced thermal headroom, and standardized design languages, which maintain performance but reduce perceived differentiation. - Why is the smartphone plateau not the end of innovation?

Innovation has shifted from visible specs to nuanced engineering: software efficiency, thermal management, AI optimization, and long-term reliability. Progress exists but is less photogenic. - How should consumers navigate 2025 smartphone choices?

Adopt a framework that evaluates thermal stability, battery longevity, software updates, and ergonomics. Prioritize substance over marketing and choose devices with credible, tested engineering.

💬 What’s your take on this?

The comment section at Vibetric isn’t just for reactions — it’s where creators, thinkers, and curious minds exchange ideas that shape how we see tech’s future.

Is a 144Hz Monitor Still Enough for Competitive Gaming?

Is a 144Hz Monitor Still Enough for Competitive Gaming? For years, 144Hz gaming monitors have been considered the baseline for competitive esports.

Are Smart Speakers Replacing Traditional Home Audio?

Are Smart Speakers Replacing Traditional Home Audio? The conversation around smart speakers vs home audio reflects something deeper than sound quality. It