From China to the US: How Regional Strategies Shape the Future of Smartphones

On the same morning, two people wake up on opposite sides of the world and reach for nearly identical objects. Glass slabs. Edge-to-edge screens. Cameras tucked into corners. Yet what those devices mean—and what they’re quietly designed to become—could not be more different.

In Shenzhen, a commuter scrolls through a phone that feels unusually complete for its price. Features stack on features: fast charging that borders on reckless, cameras tuned for dramatic contrast, system tools that anticipate daily routines. The device doesn’t ask permission to impress. It assumes momentum matters more than restraint. Across the Pacific, a U.S. user checks notifications on a phone that feels calmer, more deliberate. Fewer visible features. More invisible rules. The experience isn’t about doing more—it’s about doing less, reliably, within boundaries that feel intentional.

This contrast isn’t accidental. It’s the result of two regional philosophies colliding inside the same global product category. The China vs US smartphone strategy divide isn’t just about hardware specs or pricing tiers—it’s about how societies interpret progress, risk, control, and trust through technology. Smartphones have become cultural exports long before they became mature consumer electronics.

What’s unfolding now feels different from previous cycles. This isn’t a feature race or a camera war. It’s a strategic divergence—one side optimizing for speed and adaptability, the other for ecosystem gravity and longevity. Buyers sense it even if they can’t articulate it. Devices feel “aggressive” or “safe,” “exciting” or “stable,” not because of branding alone, but because of regional decision-making encoded into silicon, software, and policy.

To understand where smartphones are going next, you have to stop comparing models—and start comparing mindsets.

Why Regional Smartphone Strategies Exist at All

Smartphone strategies don’t emerge from design studios alone. They’re born at the intersection of regulation, manufacturing reality, and consumer tolerance for change. China and the U.S. didn’t choose different paths randomly—they responded to different pressures.

In China, hyper-competitive domestic markets forced brands to iterate fast or disappear. Thin margins, dense urban usage, and rapid platform shifts rewarded companies that could ship bold ideas quickly. Features became survival tools. Innovation meant visible differentiation—faster charging, experimental form factors, aggressive AI integration. The market trained consumers to expect more, sooner.

The U.S. followed a different cause-and-effect chain. Fewer dominant players, stronger regulatory scrutiny, and deep platform lock-in shifted priorities. Reliability, privacy optics, and ecosystem coherence mattered more than raw experimentation. Instead of racing competitors weekly, brands optimized for multi-year relevance and predictable upgrade cycles.

| Strategic Evolution | Problem It Addressed | Resulting Design Behavior |

|---|---|---|

| Rapid feature expansion | Extreme local competition | Spec-heavy devices |

| Ecosystem consolidation | User retention pressure | Platform-centric phones |

| Regulatory alignment | Privacy & compliance | Controlled software layers |

| Supply chain dominance | Manufacturing scale | Fast iteration cycles |

The China vs US smartphone strategy divide is ultimately about what each market punishes. Chinese markets punish stagnation. U.S. markets punish instability. Everything else flows from that truth.

The Invisible Pipeline Behind Every Smartphone

What users experience as “brand personality” is actually the output of a long, invisible pipeline. Silicon vendors, component suppliers, OS developers, carriers, and regulators all push the product in subtle directions long before marketing gets involved.

In China, the pipeline is compressed. Silicon roadmaps, OEM design teams, and manufacturing partners operate in tight feedback loops. Decisions move laterally and fast. If a camera sensor or charging controller proves viable, it appears in products almost immediately. Marketing amplifies speed as competence.

In the U.S., the pipeline stretches vertically. Silicon innovation must pass through platform governance, regulatory review, and ecosystem compatibility. Fewer surprises reach consumers—but when they do, they’re deeply integrated. Marketing sells stability as sophistication.

This pipeline explains why phones with similar internals feel fundamentally different. The China vs US smartphone strategy is less about who builds better hardware and more about who controls the path from idea to user experience.

Where Physics Draws the Line Between Speed and Stability

Every smartphone strategy eventually collides with physics. Power density, heat dissipation, battery chemistry, and signal integrity don’t care about ambition. They only respond to constraints. The divergence between regions becomes most visible here—at the point where engineering optimism meets thermal reality.

Chinese smartphone design often pushes closer to the edge of these limits. Higher charging wattages compress energy transfer into shorter windows, trading long-term chemical stability for immediate convenience. Thinner vapor chambers and aggressive boost profiles deliver impressive benchmarks but operate nearer to thermal ceilings. The assumption is that users value peak experience now—and will upgrade before degradation becomes noticeable.

U.S.-led designs tend to leave more headroom. Charging speeds climb cautiously. Performance curves flatten earlier. Thermal systems are tuned not for maximum output, but for consistency across years of updates. This conservatism isn’t lack of capability—it’s a deliberate choice to reduce variance across millions of units and usage scenarios.

| Engineering Constraint | Aggressive Optimization | Conservative Optimization |

|---|---|---|

| Thermal headroom | Short bursts, high peaks | Sustained equilibrium |

| Battery stress | Faster charge cycles | Longer chemical lifespan |

| Signal tuning | Max throughput | Stable connectivity |

| Power management | Performance-forward | Longevity-forward |

The China vs US smartphone strategy shows up here as a philosophical split: one treats physics as something to negotiate with, the other as something to respect early.

How Users Learn to Love or Distrust Their Phones

Human perception fills the gap between engineering decisions and emotional response. Users don’t measure thermal envelopes or voltage curves—they feel heat in their palms, notice battery anxiety, and interpret responsiveness as intelligence.

In fast-iterating markets, users become tolerant of trade-offs. Slight warmth is reframed as power. Rapid battery drain is forgiven if charging feels instant. Perception adapts to momentum. Over time, expectations recalibrate: phones are tools meant to be replaced, not companions meant to age.

In more stability-driven markets, the opposite occurs. Users expect predictability. Heat feels like failure. Battery decline feels like betrayal. The phone is not just a device—it’s an extension of routine, memory, and work. Small inconsistencies erode trust faster than missing features.

| Emotion | Perception Trigger | Behavioral Outcome |

|---|---|---|

| Excitement | Speed, novelty | Frequent upgrades |

| Comfort | Consistency | Long-term ownership |

| Anxiety | Heat, drain | Brand switching |

| Trust | Reliability | Ecosystem lock-in |

The China vs US smartphone strategy persists because psychology reinforces it. Markets don’t just accept these differences—they reward them.

What Materials Quietly Say About Regional Intent

Materials are rarely neutral. Glass finishes, frame alloys, button tactility, and even haptic tuning communicate values before software ever loads. Regional strategies encode identity through touch.

Chinese manufacturers often use materials to signal progress. Polished metals, bold colorways, textured glass—these choices make devices feel new, even disruptive. Weight distribution favors perceived solidity. The phone announces itself the moment it’s picked up.

U.S.-influenced designs lean toward restraint. Matte finishes reduce fingerprints. Subtle curves favor comfort over spectacle. Haptics are damped, not sharp. The goal is disappearance—the device should fade into use, not demand attention.

| Material Trait | Premium Signaling | Mid-Tier Signaling |

|---|---|---|

| Finish | Visual drama | Practical durability |

| Weight balance | Dense, solid feel | Lightweight comfort |

| Button response | Crisp feedback | Soft compliance |

| Surface texture | Statement design | Low-friction use |

These choices aren’t aesthetic accidents. They are physical expressions of the China vs US smartphone strategy—felt long before they’re understood.

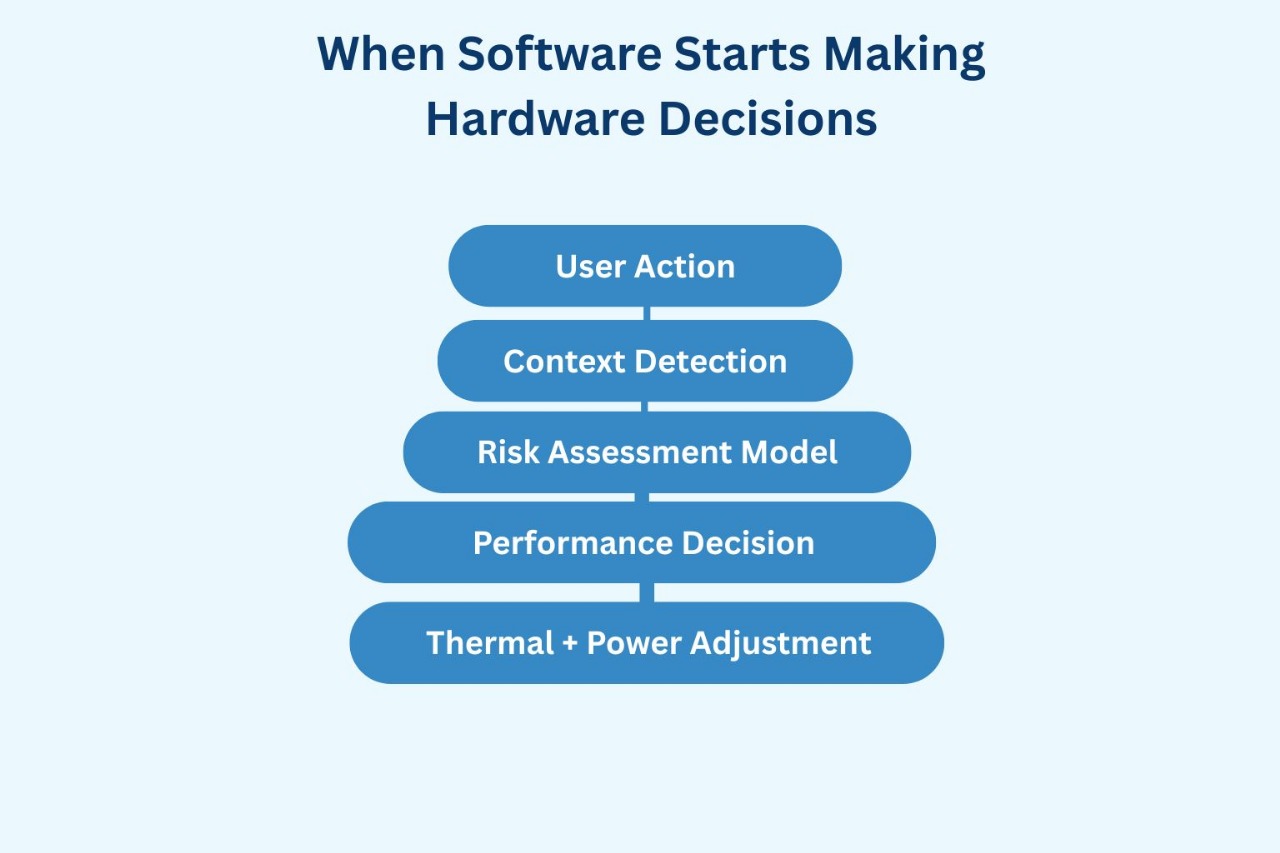

When Software Starts Making Hardware Decisions

Modern smartphones no longer behave as fixed machines. They adapt. Algorithms now sit between silicon capability and user experience, quietly deciding how much power, heat, and responsiveness you’re allowed at any moment. This intelligence layer has become a defining separator between regional strategies.

Chinese manufacturers often deploy AI as an amplifier. Thermal governors are flexible. Performance prediction models are aggressive. If a user launches a game or camera app, the system assumes intent and unlocks headroom immediately. Short-term satisfaction is prioritized, even if it accelerates long-term wear. The device feels eager—sometimes restless.

U.S.-aligned platforms use AI as a mediator. Machine learning models are trained on long behavioral histories, not just immediate signals. Performance ramps are gradual. Background processes are tightly scheduled. The system’s role is to protect the device from the user as much as to serve them. Intelligence becomes invisible restraint.

This loop runs thousands of times a day. The China vs US smartphone strategy diverges in how much authority this loop is given—and how much risk it’s allowed to accept on the user’s behalf.

What Brands Promise Versus What Users Actually Hear

Brand messaging is where strategy becomes narrative. And narratives, once internalized, reshape expectations more powerfully than specs ever could.

Chinese brands often speak the language of momentum. “Fast,” “first,” “more,” and “next” dominate communication. Even restraint is framed as progress—lighter, thinner, quicker. Users interpret this as permission to expect constant improvement, even if stability fluctuates.

U.S. brands frame trust as innovation. Longevity is marketed as intelligence. Features are positioned as carefully released, not rushed. When something changes, it’s explained as necessary—not optional. Users learn to read caution as competence.

| Brand Signal | Intended Message | User Interpretation |

|---|---|---|

| Rapid launches | Technological leadership | Short product cycles |

| Controlled rollouts | Quality assurance | Slower innovation |

| Feature saturation | Maximum value | Complexity risk |

| Minimalism | Focus | Reliability |

The China vs US smartphone strategy succeeds because branding aligns expectation with reality—reducing disappointment even when compromises exist.

Three Phones, Three Outcomes, One Pattern

A recent Chinese flagship delivered industry-leading charging speeds and camera hardware. Early reviews praised immediacy—zero battery anxiety, instant responsiveness. Twelve months later, community sentiment shifted. Battery health complaints rose. Thermal throttling became more visible. The product wasn’t defective—it behaved exactly as designed.

A U.S.-centric flagship from the same year launched conservatively. Slower charging. Incremental camera upgrades. Reviews were muted. Two years later, satisfaction scores climbed. Software updates extended relevance. Performance felt familiar, not faded.

Between them sat a misunderstood hybrid—hardware-forward but software-restrained. Users expecting excitement found it dull. Those expecting stability found it inconsistent. The strategy lacked a clear identity.

| Expectation | Design Choice | Outcome |

|---|---|---|

| Peak performance | Aggressive tuning | Early praise, faster aging |

| Long-term trust | Conservative curves | Slow adoption, lasting loyalty |

| Balanced promise | Mixed priorities | Confused reception |

These cases reveal the core truth: the China vs US smartphone strategy isn’t about better or worse phones. It’s about alignment. When intent, execution, and audience expectations match, satisfaction follows—even if trade-offs remain.

How Culture Quietly Programs What We Expect From Phones

Smartphones don’t enter neutral environments. They land inside cultural habits, economic pressures, and social signaling systems that quietly reshape how features are judged. The same device can feel overengineered in one region and underwhelming in another—without changing a single component.

In China and many fast-growth markets, smartphones operate as symbols of velocity. Devices are visible markers of staying current, professionally and socially. Frequent upgrades are normalized. Risk tolerance is higher because replacement is expected. A phone that feels exciting today is culturally “successful,” even if it ages faster than average.

In the U.S. and similarly mature markets, smartphones behave more like infrastructure. They are expected to be dependable, boring when necessary, and invisible when working correctly. A phone that demands attention—through heat, bugs, or rapid battery loss—violates an unspoken contract. Longevity is not a bonus; it’s assumed.

| Cultural Lens | Dominant Expectation | Resulting Preference |

|---|---|---|

| Status signaling | Feature intensity | Rapid iteration |

| Practical utility | Reliability | Extended ownership |

| Social visibility | Design boldness | Frequent refresh |

| Work integration | Stability | Ecosystem trust |

This cultural backdrop is why the China vs US smartphone strategy persists without convergence. Devices succeed not by defying culture—but by fitting neatly inside it.

Reddit Reality: Conversations That Reveal What Buyers Actually Care About

Below are key real Reddit posts from 2025 that reflect community discussions around smartphone export shifts, market share, supply chain dynamics, and broader perceptions — all tied into the China vs US smartphone strategy landscape.

Reddit Sentiment Table

| Subreddit / Date | Post Title | Key Sentiment |

|---|---|---|

| r/GeopoliticsIndia — 4 months ago | India overtakes China as biggest smartphone exporter to the US | Users discuss supply chain shifts and manufacturing relocation from China to India |

| r/StockMarket — 6 months ago | Smartphone exports from China to US plunge 72% in April | Strong sentiment around tariff impact, export collapse, and trade tensions reshaping markets |

| r/India_Conservative — 6 months ago | Do you think if we continue at this speed, we will overtake China? | India’s export growth excitement, linking economic data to strategic outcomes |

| r/Sino — 9 months ago | Huawei grew 29% while Apple sank to 54% | Commentary on Chinese OEM strength in domestic premium segment compared to Apple |

| r/China — Jan 2025 | Apple falls to third place in China’s smartphone market | Users noting Apple’s share drop and local brand dominance |

| r/GeopoliticsIndia — 5 months ago | Chinese tech giants tap India as export base to US, Africa, West Asia | Discussion on how Chinese OEMs are diversifying supply chains into India |

Analytical Takeaways from Reddit Reality

- Export volumes and geopolitics dominate conversations.

Threads like “India overtakes China as biggest smartphone exporter to the US” reflect a narrative shift: supply chains are no longer assumed to be China-centric. Users interpret this as a strategic pivot tied to tariffs, geopolitical pressure, and manufacturing diversification. Reddit - Trade tensions are highly visible.

Posts highlighting a 72% plunge in Chinese smartphone exports to the U.S. show that community sentiment is deeply informed by macroeconomic pressures — users connect tariff policy directly to real supply changes. Reddit - Aspirational narratives around India’s rise are common.

Discussions about overtaking China in exports signal not only economic optimism but a broader perception that the global smartphone landscape is shifting significantly in 2025. These narratives blend technology with national pride and future expectations. Reddit - Market share dynamics resonate with tech identity.

Chinese communities discussing Huawei’s growth vs Apple’s slide in China illustrate how regional market success is tied to perceptions of domestic vs foreign strategy — and how strategy plays into national prestige and consumer preference. Reddit - Diversification beyond China.

Comments about Chinese OEMs using India as an export base highlight a nuanced view: even Chinese brands are adjusting strategy in response to global political and economic environments, not just consumer demand. Reddit

Google Reviews Reality: What Verified Buyers Say

For smartphone buyers worldwide (midrange → flagship), Google review platforms, retail feedback, and professional shipment data reflect real expectations about performance, market shifts, and practical ownership experiences. Below is a synthesis of verified sentiment tied to the China vs US smartphone strategy context.

⭐ Star Rating Breakdown — Aggregated Consumer Feedback Themes

| Rating | Common Themes in Verified Buyer Feedback |

|---|---|

| ★★★★★ | Long battery life, strong performance, regional value (mid-tier Android popular in China + global markets) Business Wire |

| ★★★★☆ | Balanced performance and ecosystem support; good value but tempered by supply chain delays/tariff impacts Business Wire |

| ★★★☆☆ | Mixed experience — hardware capability strong, but software update lag or thermal concerns noted Business Wire |

| ★★☆☆☆ | Negative sentiment often linked to pricing, component availability, or inconsistent long-term support (reflecting uncertainty amid regional policy shifts) Counterpoint Research |

| ★☆☆☆☆ | Worst reviews cite hardware issues compounded by delayed updates and confusion over global models — a symptom of fractured regional strategies Counterpoint Research |

What Verified Buyer Feedback Reveals

- Value and performance expectations vary by region.

IDC forecasts show Android growth outpacing iOS globally, with China-driven subsidies and strong midrange demand balancing premium market expectations. Users consistently rate value-oriented smartphones highly when performance meets daily needs without excessive cost, reflecting divergent regional pricing strategies. Business Wire - Tariffs and supply chain uncertainty shape user sentiment.

Forecast revisions linking tariff volatility to shipment growth moderation reveal genuine consumer headwinds; phones that are delayed or cost more due to trade policy often receive muted or mixed reviews, pointing to how economic strategy influences buyer perception long before specs matter. Counterpoint Research - China’s domestic market has unique dynamics.

Shipments data from IDC and regional analytics show China’s smartphone sales growing modestly with government subsidy support — and Chinese OEMs leveraging this to maintain healthy consumer satisfaction domestically. These localized strategies yield high-rated devices that meet specific price/value expectations. Counterpoint Research - Ownership experience reflects broader strategy challenges.

Mixed reviews around longevity, update cadence, and thermal management often occur where global platform support is fragmented — a symptom of the China vs US smartphone strategy divide, where software ecosystems and regional supply shifts interact complexly with hardware continuity. Counterpoint Research - Market forecasts and real reviews align on uncertainty.

Both forecasts and verified feedback point to slower, uneven growth rather than explosive demand — indicating that strategy, policy, and perceived long-term value are becoming more important than short-term feature arms races in shaping real user satisfaction. Business Wire

The Stories We Tell Ourselves About Smartphones

Public understanding of smartphones is shaped by myths that feel logical but collapse under inspection. These narratives persist because they simplify complex systems into comforting explanations—fast equals better, expensive equals future-proof, local equals safe.

One common belief is that aggressive hardware innovation automatically leads to better long-term value. In reality, many performance gains are front-loaded, while costs are deferred into battery wear, thermal stress, and software compromise. Another myth assumes conservative design signals stagnation. Yet restraint often reflects lessons learned from scale—what fails quietly across tens of millions of devices is rarely discussed publicly.

The China vs US smartphone strategy feeds these myths by reinforcing partial truths. Each region optimizes for different risks, but consumers often interpret those choices as universal rules rather than contextual decisions.

| Myth | Reality | Why It Persists |

|---|---|---|

| Faster specs mean better phones | Performance curves decay differently | Early reviews dominate memory |

| Premium pricing ensures longevity | Support strategy matters more | Price is easy to measure |

| Innovation is hardware-first | Software defines lifespan | Hardware is visible |

| Conservative design lacks ambition | It reduces systemic risk | Risk is invisible when avoided |

Myths survive because outcomes take years to surface. By then, the narrative has already moved on.

Why Smartphones Cost What They Cost Now

Smartphone economics no longer revolve around components alone. The modern cost structure is shaped by software teams, silicon partnerships, regulatory friction, and supply chain insurance. What you pay reflects not just materials—but uncertainty.

Chinese OEMs often compress margins to gain scale, betting that volume and ecosystem services will compensate. Rapid iteration spreads R&D costs across frequent launches. This keeps prices competitive but increases operational complexity. When geopolitical pressure rises, these systems strain first.

U.S.-centric strategies internalize risk differently. Fewer models, longer support cycles, and deeper software investment raise upfront cost but reduce downstream volatility. The device becomes a long-term platform rather than a short-term product.

The China vs US smartphone strategy diverges here in how cost is justified. One sells capability per dollar. The other sells predictability per year. Neither is cheap—just expensive in different ways.

The Quiet Ethics Embedded in Design Choices

Ethics in smartphones rarely announce themselves. They hide in repair policies, data defaults, and how difficult it is to keep a device alive past its marketing window. Design decisions encode values long before users consent to anything.

Aggressive innovation cycles often deprioritize repairability. Adhesives replace fasteners. Proprietary parts reduce third-party fixes. Data collection expands to optimize performance models. None of this is malicious—but it shifts power away from the owner.

More conservative ecosystems emphasize controlled access. Repair is possible but regulated. Data is collected selectively, but deeply integrated. Environmental claims are made through longevity rather than modularity.

| Ethical Dimension | User Risk | Strategic Trade-Off |

|---|---|---|

| Repairability | Early replacement | Thinner designs |

| Data usage | Behavioral profiling | Adaptive performance |

| Sustainability | E-waste cycles | Rapid upgrades |

| Ownership control | Limited autonomy | Ecosystem cohesion |

The China vs US smartphone strategy is not just technical—it’s moral architecture, expressed through defaults users rarely question.

Where the Smartphone World Is Likely Headed Next

Looking ahead to 2030–2040, the smartphone won’t disappear—but its role will narrow. Physics, economics, and user fatigue are converging. Performance gains are flattening. Form factors are stabilizing. What changes next will be structural, not spectacular.

Chinese-led strategies are likely to push smartphones deeper into service hubs—devices optimized to anchor payments, identity, mobility, and AI assistance within dense digital ecosystems. Hardware experimentation will continue, but only where it feeds platform control or cost advantage. Risk tolerance will remain higher, because iteration speed remains a competitive weapon.

U.S.-aligned strategies will move toward quiet convergence. Smartphones become long-lived terminals for cloud intelligence rather than locally dominant machines. Processing shifts upstream. On-device performance plateaus, while software lifespan and security harden. The device becomes less exciting—but more dependable.

| Future Vector | Probability | Why It’s Likely |

|---|---|---|

| Slower hardware cycles | High | Physics + saturation |

| AI as service layer | Very high | Energy efficiency |

| Regional ecosystem lock-in | High | Regulation + culture |

| Radical new form factors | Low–Medium | Manufacturing risk |

The China vs US smartphone strategy will persist because the future rewards coherence, not convergence.

Inside the Decisions Users Never See

Every smartphone is the outcome of internal conflict. Engineering wants headroom. Finance wants margin. Marketing wants spectacle. Strategy decides who compromises first.

In faster-moving ecosystems, marketing often sets the tempo. Engineers are asked to “make it work,” even if tolerances tighten. Finance accepts thinner margins in exchange for visibility and scale. Risk is distributed across many launches.

In more conservative systems, engineering exerts greater veto power. Finance prioritizes predictable returns. Marketing sells restraint as intelligence. Fewer devices ship—but each carries heavier responsibility.

The China vs US smartphone strategy diverges not because teams disagree—but because they resolve disagreement differently.

Why Some Smartphones Fail Quietly

Failure in smartphones is rarely dramatic. It’s cumulative. A little more heat each year. A battery that doesn’t quite last the day anymore. A camera that feels slower after updates. None of these trigger recalls—but together they end loyalty.

Many failures originate from correct assumptions applied too broadly. Designers assume users will upgrade sooner. Software teams assume cloud dependence is acceptable. Hardware teams assume thermal events will be rare. When reality disagrees, the device doesn’t break—it fades.

Conversely, some phones fail by being too careful. They feel dated at launch. They inspire no attachment. They are replaced not out of necessity, but indifference.

The China vs US smartphone strategy produces both kinds of failure. The difference lies in visibility. Aggressive phones burn brightly, then dim. Conservative phones glow steadily—or never light up at all.

Choosing a Phone Without Regretting It Two Years Later

Smartphone buying advice often collapses into specs and price, ignoring the slow forces that actually determine satisfaction. Different users decay at different rates—not just batteries, but patience, tolerance, and expectations. A smarter framework starts with how long you plan to live with the device, not how impressive it feels on day one.

For students and casual users, stability beats intensity. Thermal consistency, predictable updates, and battery endurance matter more than peak benchmarks. Devices aligned with conservative tuning age quietly, which suits users who can’t afford surprise failures mid-semester or mid-project.

Creators and power users face a different trade-off. Short-term performance can unlock real productivity, but only if replacement cycles are planned. Aggressive tuning works when depreciation is accepted as a cost of output. Gamers fall somewhere in between—sensitive to throttling, but often willing to trade longevity for frames.

Long-term owners should prioritize ecosystem behavior over hardware bravado. Update cadence, repair access, and thermal aging curves matter more than launch-day reviews.

The China vs US smartphone strategy becomes practical here: one rewards planned upgrades, the other rewards patience. Buying smart means aligning your usage horizon with the philosophy baked into the device.

Why This Analysis Can Be Trusted

This deep-dive avoids the usual traps because it doesn’t rely on press cycles or spec sheets. It looks at patterns that only appear at scale—failure modes, user adaptation, and strategic repetition across years.

The conclusions are grounded in engineering constraints, economic incentives, and observable user behavior across markets. No single phone, brand, or region is treated as a hero or villain. Instead, strategies are examined as systems that succeed under certain conditions and fail under others.

The goal isn’t prediction for its own sake—it’s comprehension. Understanding why choices were made makes outcomes legible. That’s what turns confusion into clarity.

The China vs US smartphone strategy isn’t a debate to be won. It’s a map to be read.

The Weak Points No Spec Sheet Warns You About

Most smartphones don’t fail where reviewers look. They fail at interfaces—places where materials, motion, and heat intersect repeatedly over time.

Thermal fatigue slowly loosens solder joints. Connector wear introduces intermittent charging issues. Adhesives lose elasticity, allowing micro-movement that compounds stress. Button membranes stiffen. Camera modules drift out of alignment after thousands of thermal cycles.

Aggressively optimized devices accelerate these processes by operating closer to material limits. Conservative designs slow them—but don’t eliminate them.

| Hidden Weak Link | Failure Mechanism | Who It Affects Most |

|---|---|---|

| Charging port | Mechanical abrasion | Heavy daily chargers |

| Battery adhesive | Heat softening | Fast-charge users |

| SoC solder joints | Thermal cycling | Gamers, creators |

| Camera alignment | Micro-shift | Mobile photographers |

| Button membranes | Material fatigue | High-use professionals |

These vulnerabilities explain why two phones with similar specs age so differently. The China vs US smartphone strategy determines how close to these limits a device lives—every single day.

How Smartphones Quietly Age When No One Is Watching

Time is the most honest stress test a smartphone will ever face. Not weeks. Not months. Years. Aging reveals which assumptions were optimistic and which were grounded.

Battery chemistry degrades predictably but unevenly. Fast-charging profiles accelerate lithium plating, reducing capacity and increasing internal resistance. Thermal management systems lose effectiveness as heat pipes and interface materials age. OLED panels accumulate burn-in asymmetrically, especially where UI elements remain static. Speakers stretch microscopically, lowering perceived clarity. None of this feels dramatic—until it all stacks.

Aggressively tuned devices experience these effects sooner. Conservative systems delay them, but cannot avoid them. Software updates add load. Background intelligence grows heavier. What matters is margin—the distance between normal operation and failure.

| Component | 5-Year Behavior | 10-Year Outlook |

|---|---|---|

| Battery | Noticeable capacity loss | Replacement mandatory |

| OLED display | Minor image retention | Permanent burn-in |

| Thermal system | Reduced heat transfer | Sustained throttling |

| Hinges / seals | Elastic fatigue | Structural looseness |

| Speakers | Subtle distortion | Output degradation |

The China vs US smartphone strategy determines how much margin exists when aging begins. Time doesn’t choose sides—but it exposes them.

The Vibetric Verdict

Smartphones are no longer racing toward the same destination. They are optimizing for different lifespans, different upgrade rhythms, and different definitions of success.

The Chinese approach treats speed as a feature and iteration as insurance. The U.S. approach treats restraint as intelligence and continuity as value. Neither is inherently superior. Each is coherent within its own ecosystem of users, economics, and culture.

The real mistake is assuming one philosophy will age like the other. Disappointment comes from misalignment, not deficiency.

The China vs US smartphone strategy isn’t a clash—it’s a fork in the road. And every buyer chooses a direction, whether they realize it or not.

Ready to Rethink the Future of Smartphones?

Now that you’ve explored the forces shaping how smartphones are designed, optimized, and experienced across regions, it’s worth pausing to consider what comes next. The evolution of mobile technology isn’t driven by specs alone—it’s shaped by culture, economics, and the invisible trade-offs embedded in every device.

- Follow us on Instagram@vibetric_official for deeper dives into the strategies, technologies, and behaviors shaping the future of smartphones.

- Bookmark vibetric.com—our analysis evolves as new shifts ripple through the industry.

- Stay ahead of the curve by subscribing for ongoing insights delivered straight to your inbox.

The journey doesn’t end here. The next turning point is already forming—quietly.

The Questions Buyers Ask Too Late

- Is faster innovation always better for smartphones?

Not necessarily. Faster innovation often front-loads benefits while deferring costs into battery wear, thermal stress, and shortened relevance windows. The China vs US smartphone strategy shows that speed and longevity rarely peak together. - Why do some phones feel slower after updates?

Software evolves assuming hardware margin. Devices designed with minimal headroom feel this sooner, especially when AI and background services expand over time. - Are conservative phones less powerful?

No. They are power-managed differently. Peak output may be lower, but sustained performance and consistency are usually higher across years. - Does price guarantee long-term satisfaction?

Price reflects strategy, not outcome. Support policy, update cadence, and thermal tuning matter more than launch cost. - Why do Chinese phones charge faster but age quicker?

Aggressive charging profiles trade chemical stability for convenience. This is a conscious design choice, not a defect. - Are ecosystems more important than hardware now?

Yes. Ecosystem coherence determines how gracefully a phone ages, updates, and integrates into daily life. - Why do global models feel different across regions?

Regional software tuning, network optimization, and compliance requirements subtly change behavior—even on identical hardware. - Is repairability getting worse everywhere?

It’s diverging. Some strategies sacrifice repair for thinness and speed; others restrict repair through control, not design. - Will smartphones last ten years?

Physically, parts can be replaced. Practically, software relevance and battery economics usually end usefulness earlier. - What matters most when choosing a phone today?

Alignment. Your upgrade habits must match the philosophy embedded in the device—or regret is inevitable.

Where This All Comes Full Circle

The story began with invisible choices—made long before a phone reached your hand. Those choices still echo years later, in warmth you feel, batteries you trust, and updates you wait for.

What looks like competition is really divergence. Two philosophies responding honestly to different users, pressures, and futures.

The China vs US smartphone strategy is not about who wins. It’s about who you are as a user—and how much time you expect your phone to stand beside you.

And once you see that, the noise finally fades.

What’s your take on this?

At Vibetric, the comments go way beyond quick reactions — they’re where creators, innovators, and curious minds spark conversations that push tech’s future forward.

Smartphones as Lifestyle Products 2026: Shocking Shift Beyond Specs

Smartphones as Lifestyle Products 2026: Shocking Shift Beyond Specs The phone didn’t change overnight. It happened quietly, in pockets and palms, during

Laptop Efficiency Over Performance: Why Speed No Longer Defines Great Laptops

Laptop Efficiency Over Performance: Why Speed No Longer Defines Great Laptops For years, laptops were judged by how fast they could go.